Purpose-Led Growth in a Dynamic Landscape

At Lupin, our purpose — We catalyze treatments that transform hope into healing — anchors our strategy and propels our execution. FY25 was a pivotal year where disciplined performance, strategic clarity, and bold investments converged to drive exceptional outcomes. We accelerated momentum across our key markets, deepened our innovation pipeline, fortified operational resilience, and made strong progress across ESG, all while navigating a dynamic and complex global landscape.

This Integrated Report presents a detailed view of Lupin’s operational and financial performance for FY25, along with insights into the external environment, opportunities, threats, segment-wise performance, risks, governance, financial controls, and outlook.

Navigating a Changing Global and Industry Landscape

Global Economic Outlook: Stabilization Amid Structural Headwinds

The global economy is gradually stabilizing, but remains below its long-term growth potential. According to the World Bank, global GDP is projected to grow at 2.7% through 2025–26, remaining 0.4% below the average annual growth seen in the decade before the pandemic. Trade and investment are expected to expand at a slow pace across advanced and emerging economies, reflecting a decline in economic dynamism.

Advanced economies are projected to grow at 1.7%, with the U.S. maintaining relative resilience despite inflationary overhang and policy shifts. Meanwhile, growth across emerging markets and developing economies is expected to average around 4%, but with notable divergence — China’s deceleration continues due to weak domestic demand, while South Asia demonstrates robust growth, led by India’s strong fundamentals and policy-driven reform momentum. With robust domestic demand, a stable macroeconomic foundation, and rising healthcare investments, the country continues to anchor South Asia’s forecasted growth rate of 6.2%. This macro backdrop augurs well for the pharmaceutical sector, both in India and globally.

India’s Pharmaceutical and Healthcare Outlook: From Volume to Value

India’s GDP is expected to grow at 6.7% in FY25, moderating from 8.2% in the previous year, but continuing to be one of the most dynamic economies in the world. Within this context, the pharmaceutical sector remains resilient and vibrant.

The Indian pharmaceutical industry is poised for a 2.2x expansion over the next five years, driven by a combination of export growth, innovation-led transformation, and digital acceleration (EY-FICCI Pharma Report, 2024). But the real inflection lies in the sector’s pivot — from being primarily prescription-driven to embracing a holistic healthcare opportunity that includes diagnostics, digital therapeutics, medtech, and wellness in addition to medicines.

Artificial intelligence and automation are rapidly emerging as key drivers throughout the pharmaceutical value chain, encompassing early-stage research and development as well as commercial operations. At the same time, infrastructure investments and growing digital penetration are unlocking access to healthcare in previously underserved regions.

Lupin’s strategy in India is deeply aligned with this shift. Our expertise across chronic therapies, diagnostics, digital health, OTC, and neuro-rehabilitation, enables us to effectively address diverse healthcare needs, while retaining our leadership in affordable, trusted medicines.

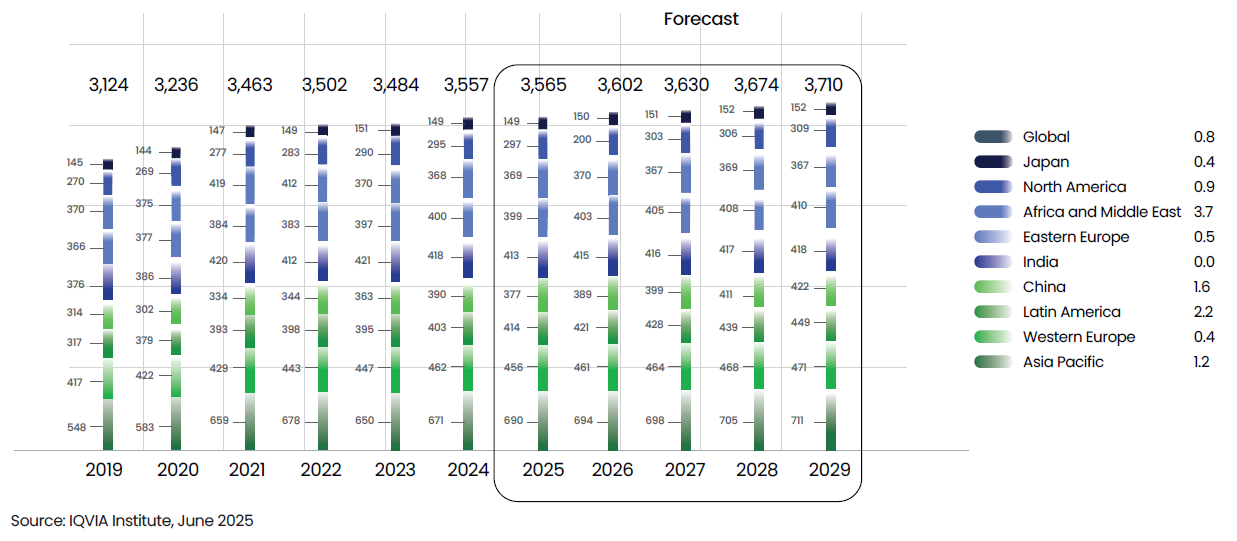

Historic and projected use of medicines by region, 2019-2029, Defined Daily Doses (DDD) in billions

Global Pharmaceutical Market: Usage and Value Outlook

The global pharmaceutical landscape continues to evolve rapidly, shaped by expanding access, demographic shifts, and the growing burden of chronic diseases. As health systems worldwide recover from pandemic disruptions and embrace innovation, both medicine usage and spending are projected to rise steadily through 2029.

Global medicine consumption is forecasted to reach 3.71 trillion Defined Daily Doses (DDDs) by 2029, up from 3.56 trillion in 2024 — reflecting a modest 0.8% CAGR. While the growth is slower than previous years, it underscores the resilience of global health systems and the continued expansion of access in emerging regions. The growth is largely fueled by expanded access across Africa and Middle East, Latin America, Asia and Eastern Europe, and by rapid uptake in China and the broader Asia Pacific region. Each market is projected to exceed the volume growth of 0.5% CAGR over the next 5 years.

The global pharmaceutical spending is projected to reach USD 2.4 trillion by 2029, growing at a 5–8% CAGR. This growth is driven by a mix of factors:

- New and existing branded medicines in developed markets remain the primary growth engines.

- Losses of exclusivity will offset growth, with an estimated USD 220 Bn in brand erosion over five years.

- Biotech therapies are expected to contribute USD 820 Bn, accounting for 34% of global spend.

- Specialty medicines will represent 46% of global spending, and 54% in developed markets, reflecting the shift toward complex, high-value treatments.

Therapeutic Area Highlights

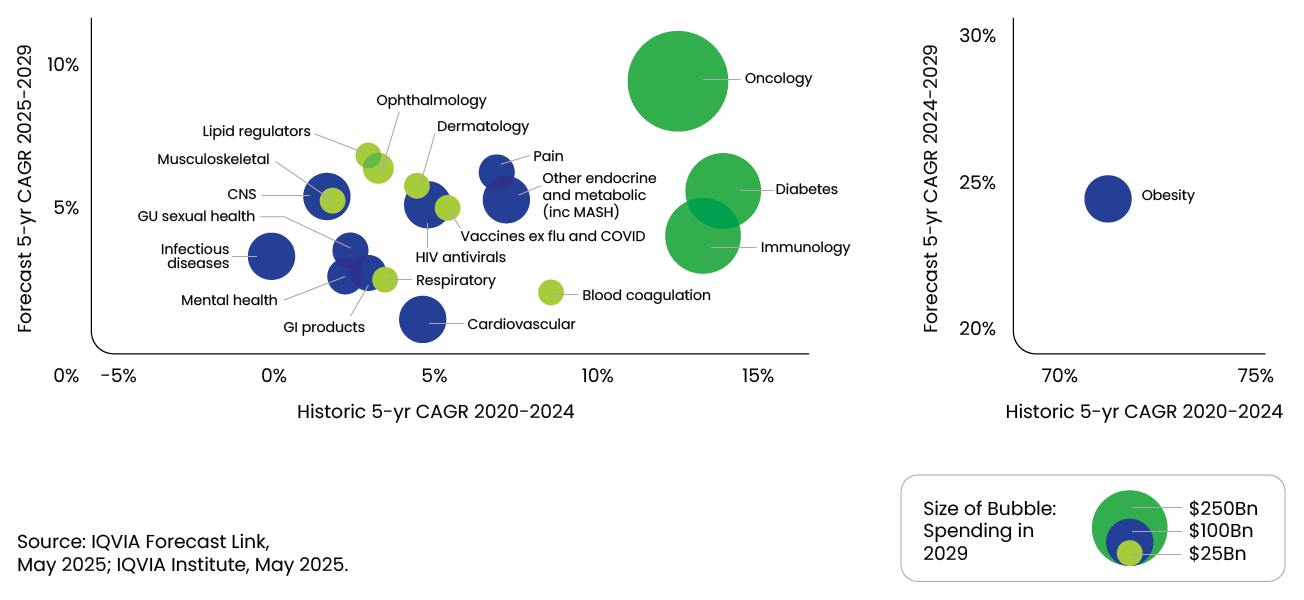

- Oncology remains the largest and fastest-growing therapy area, forecasted to reach USD 441 Bn by 2029, growing at 11–14% CAGR.

- Obesity treatments, driven by GLP-1 agonists, are transforming care paradigms, with spending projected to hit USD 76 Bn by 2029, at a 23–26% CAGR.

- Immunology and diabetes will continue to grow, though at slower rates due to biosimilar competition and pricing pressures.

- Neurology, especially Alzheimer’s and mental health, is poised for a resurgence, with novel therapies driving USD 31 Bn in incremental spending.

These shifts reinforce the growing synergy between innovation, affordability, and access — a space where Lupin’s global presence, portfolio focus, and manufacturing strength, place us in a favorable position in this dynamic environment.

Global historic and forecast growth for top 20 therapy areas

Strategic Trends Shaping the Industry

The pharmaceutical industry is at an inflection point. Beyond macroeconomics, several strategic forces are reshaping how companies operate, innovate, and compete.

Geopolitical Realignment and Supply Chain Localization

Ongoing trade tensions, especially between the U.S. and China, as well as regional conflicts, are leading to a rethink of global supply chains. Policies like the proposed Biosecure Act in the U.S., aimed at reducing dependency on China, are prompting global pharma players to diversify suppliers and invest in regional manufacturing hubs. Lupin, with its robust India-based manufacturing and CDMO operations, is well placed to support this transition.

U.S. Healthcare Transformation

The U.S. healthcare system is undergoing a structural transformation toward value-based care, digital health integration, and pricing reform. The Inflation Reduction Act is driving changes in drug pricing, reimbursement, and biosimilar adoption. Spending is expected to grow at 2–5% CAGR on a net basis. (Source: IQVIA, Understanding the Use of Medicines in the U.S. 2025)

Growing U.S. Onshoring Amid Looming Tariffs

Amid rising tariffs and geopolitical uncertainty, U.S. pharma companies are increasingly onshoring manufacturing and investing in domestic capacity to reduce dependency on China and India. This shift is expected to enhance supply chain resilience and regulatory compliance.

Indian Pharma Industry Poised for Growth

The Indian pharmaceutical sector is expected to double in size by 2030, fueled by exports, complex generics, and specialty therapies. The industry is transitioning from volume-driven generics to value-added platforms, including injectables, biosimilars, and novel drug delivery systems.

India’s Healthcare Opportunity Expands Beyond Pharma

India is fast evolving into a comprehensive healthcare hub, integrating pharmaceuticals with diagnostics, medtech, digital health, and wellness services. This development is attracting global investment and accelerating innovation across the healthcare spectrum.

Hybridization of Generic Players

Generic manufacturers are shifting towards hybrid models, investing in complex generics, inhalation therapies, injectables, and specialty pipelines. This transition is driven by margin pressures, regulatory complexity, and the need for differentiation in global markets.

Rising Impact of AI Across Industries

AI is revolutionizing pharma across the value chain—from drug discovery and clinical trials to commercial analytics and supply chain optimization. GenAI is expected to deliver up to 11% value relative to revenue in biopharma, with applications in molecule design, patient stratification, and predictive modeling. (Source: McKinsey, 2024)

Blockbuster Drug Classes Driving Investment

Blockbuster therapies in oncology, obesity, immunology, and neurology are attracting significant investment. GLP-1 agonists alone are forecast to reach USD 74 Bn in spending by 2028, reshaping treatment paradigms and payer strategies. (Source: IQVIA, 2024)

The Sector at a Critical Juncture

The global pharmaceutical industry is undergoing strategic shifts. However, despite economic pressures, opportunities are abundant. The increasing usage of medicines, specialty-led value creation, digital advancements, and the shift towards holistic healthcare models are reshaping the competitive landscape and avenues for growth. India with its manufacturing scale, clinical talent, and digital-first approach, is uniquely poised to lead. At Lupin, our strategic initiatives are closely aligned with this vision: to transcend the traditional role of a pharma company and become a trusted healthcare catalyst — providing scientific innovation, access to healthcare, and hope.

Opportunities and Threats

Opportunities: Scaling Impact Across Therapeutic, Geographic, and Capability Frontiers

Lupin stands at the convergence of multiple opportunity vectors — innovation, market expansion, digital transformation, and healthcare accessibility. These are strategic enablers that align with our purpose of catalyzing treatments that transform hope into healing.

Accelerated Growth in Complex Generics and Respiratory Therapies

Lupin’s emphasis on complex generics and inhalation therapies, particularly in developed markets, positions us in a high-value segment with relatively lower competitive intensity. Our recent launches, including products like Albuterol, Tiotropium, Mirabegron, reflect our strength in this space.

Expansion in the U.S. and Canada Through Differentiated Portfolios

North America remains the largest and most regulated pharma market globally, with an increasing demand for cost-effective therapies amid policy shifts such as the U.S. Inflation Reduction Act. Lupin’s investments in inhalation, injectables, and biosimilars will enable deeper penetration in this geography.

India’s Healthcare Evolution: From Generics to Integrated Care

India’s pharmaceutical market is expected to grow 2.2x by 2030 (EY-FICCI Report, 2024). As the country moves towards holistic healthcare, areas such as diagnostics, digital therapeutics, OTC and neuro-rehab present significant growth potential. Lupin has already made early moves via Lupin Diagnostics, Lupin Digital Health, LupinLife, and Atharv Ability.

CDMO Growth via Lupin Manufacturing Solutions

With global pharma companies diversifying away from China, India’s CDMO market is projected to grow from USD 3.5 Bn to USD 25 Bn over the next decade. Lupin Manufacturing Solutions (LMS) is strategically positioned with a differentiated model, dedicated capacities, and quality-first operations to become a preferred global API CDMO partner.

API Plus: Reclaiming Global Supply Chain Relevance

As the world seeks secure and diversified API sources, Lupin’s API Plus business, built on decades of process chemistry and fermentation expertise, offers global customers credible, cost-effective, and high-quality solutions. Recent expansions and regulatory approvals enhance our readiness.

Digital Transformation and GenAI for Operational Efficiency

A digital-first approach, advanced analytics, and GenAI are driving competitive advantage across the pharma value chain. Lupin’s digital interventions across supply chain, manufacturing, and sales force effectiveness are yielding measurable outcomes.

Sustainability as a Strategic Differentiator

With customers, investors, and regulators increasingly focused on ESG performance, Lupin’s water stewardship, climate action, and circular economy initiatives are enhancing our license to operate and collaborate. The Silver rating by EcoVadis and being featured in the top 10% of the CSA ranking by S&P Global are credible validations of our efforts in this direction.

Threats: Managing Volatility, Regulation, and Global Uncertainty

The global pharmaceutical industry, while opportunity-rich, is not without risk. At Lupin, we apply a structured Enterprise Risk Management (ERM) framework to anticipate, prioritize, and mitigate these threats (refer to the Enterprise Risk Management section on page 134).

Regulatory Stringency and Compliance Pressure

With evolving regulatory frameworks in key markets such as the U.S., EU, and Australia, the cost and complexity of compliance continue to rise. Any deviation can lead to product recalls, import alerts, or reputational damage. Lupin addresses this through its Global Quality Organization, all-time audit readiness program, and site-wise compliance dashboards.

Pricing Pressure in Mature Markets

In the U.S. generics market, base price erosion remains a challenge, mainly for commoditized molecules, despite some stabilization. The consolidation of payers and the introduction of new tender models in Europe are also contributing to margin compression. Lupin’s strategic shift towards complex generics and specialty products is designed to mitigate this risk.

Raw Material and Logistics Volatility

API and Key Starting Material (KSM) prices remain volatile, influenced by geopolitical events, environmental compliance in supplier countries, and supply-demand discrepancies. Coupled with global freight and logistics inflation, this creates cost headwinds. Lupin uses multi-sourcing strategies, long-term vendor contracts, and local backward integration to manage volatility.

Foreign Exchange Risks

Operating in 100+ markets exposes Lupin to currency fluctuations, particularly those of USD-INR, EUR-INR, and ZAR-INR. While natural hedges and forex derivatives are deployed, extreme currency movements can impact profitability. Lupin’s treasury operations actively monitor exposures and adopt layered hedging strategies.

Geopolitical Instability and Policy Shocks

Events such as the Russia-Ukraine conflict, U.S.-China trade tensions, and Middle East volatility, pose a threat to global pharma logistics and operations. Further, the potential enforcement of tariffs and protectionist measures could disrupt China and India-based sourcing and shift regulatory expectations.

Data Privacy and Cybersecurity

With increased digitalization comes greater exposure to cyber threats and data breaches, both at enterprise and patient data levels. Lupin has strengthened its cybersecurity framework through robust monitoring, penetration testing, and employee sensitization programs, aligned with global standards.

Talent Retention and Capability Gaps

The global shortage of high-skill professionals in data science, regulatory affairs, and advanced manufacturing, presents a medium-term risk. Attrition in field forces and niche capabilities may impact business continuity. Lupin addresses this through succession planning, upskilling programs, and inclusion-led hiring.

Segment-Wise Performance

Lupin’s performance in FY25 was driven by balanced growth across its key business segments — India, North America, Other Developed Markets, Emerging Markets, and API. Each segment contributed to expanding our impact and advancing our purpose.

North America: Building a Complex Generics Powerhouse

North America continued to be our critical strategic growth engine in FY25, led by differentiated product launches, improved market share, and greater pricing resilience. Our U.S. generics portfolio grew steadily, driven by performance in respiratory, injectables, and niche oral solids. Lupin continued to expand its complex generics footprint through investments in R&D, regulatory filings, and targeted launches. FY25 also saw us consolidate our market presence across key customers, improve our service levels, and strengthen our supply chain agility. Our differentiated U.S. portfolio comprising complex generics is a testament to our long-term strategy of investing in technically complex, high-barrier products that create value for patients and partners alike.

In Canada, our business delivered double-digit growth, led by specialty generics. With a strong pipeline and expanded access, we are well-positioned to build on this performance in FY26.

Refer to the North America chapter on page 44 for further details.

India Region: Anchored in Chronic Leadership, Expanding in Adjacencies

Our India business continued to be a cornerstone of Lupin’s global performance, contributing 34% of the overall sales for FY25. Despite macroeconomic moderation, the India business outpaced IPM growth, underpinned by our focused leadership in chronic therapies and expanding presence in fast-growing segments. We maintained category leadership in cardiology, anti-diabetes, respiratory, and gastrointestinal therapies — all of which are high-burden, long-term conditions impacting millions of Indians. Our top brands sustained and improved their rank in the IPM, and we continued to strengthen medical engagement, last-mile reach, and prescriber loyalty through a digitally enabled field force and superior in-clinic activation.

Beyond branded generics, Lupin’s adjacencies in India reflect a strategic pivot to holistic healthcare solutions. LupinLife, our OTC vertical, expanded distribution and consumer engagement in preventive health categories. Lupin Diagnostics achieved scale, particularly in underserved cities. Lupin Digital Health further deepened the penetration of digital therapeutics through our patient monitoring solution for cardiac conditions, offering clinicians real-time data to optimize care. Atharv Ability, our neuro-rehabilitation venture, expanded its footprint, responding to India’s significant unmet need in stroke and brain injury recovery. Lupin Life Sciences, our trade generics arm, strengthened its foothold with a focused, field-driven model that enabled better medicine accessibility.

Our India business exemplifies purpose in action — delivering trusted, affordable therapies and broadening our role from pharmaceutical care to holistic healthcare.

Refer to the India Region chapter on page 38 for an in-depth view of performance, brands, and adjacencies.

Other Developed Markets: Portfolio, Quality, and Regulatory Agility Driving Growth

In Europe and Australia, Lupin’s presence continued to expand in FY25 through consistent execution and deepening stakeholder relationships. Our businesses in the United Kingdom, Germany, and Australia recorded healthy year-on-year growth, supported by a focused respiratory and specialty product pipeline.

The region benefitted from our product portfolio, strong compliance track record, regulatory agility, and high-quality standards — factors that remain critical to sustaining partnerships in tightly governed markets. Continued expansion into high-value complex generics further contributed to improved salience and profitability.

Refer to the Other Developed Markets chapter on page 46 for product-wise and country-specific highlights.

Emerging Markets: Portfolio Localization and Tender-Driven Expansion

Lupin’s performance across South Africa, Brazil, Mexico, and the Philippines was marked by volume growth, market-specific strategies, and efficient cost structures. These markets, characterized by rising healthcare demand and evolving public-private healthcare systems, offer us the opportunity to extend access through localized portfolios and targeted partnerships.

In South Africa, Lupin remained among the top generic companies. In the Philippines, our subsidiary Multicare Pharmaceuticals, continued to consolidate leadership in women’s health and pediatrics. Mexico and Brazil contributed through institutional business, localized marketing, and channel expansion.

Our approach in these regions prioritizes market-appropriate products, operational agility, and compliance, enabling us to deliver affordable and effective treatments in high-need geographies.

Refer to the Emerging Markets chapter on page 48 for details on country performance and strategic partnerships.

API Plus and Lupin Manufacturing Solutions: Building Strategic Depth Across Supply Chains

Lupin’s API and CDMO businesses, comprising of the legacy API and Lupin Manufacturing Solutions (LMS), reflected strong alignment with global industry trends such as supply chain diversification, CDMO outsourcing, and high-potency APIs.

Our APIs strengthen key therapeutic areas globally and benefit from robust quality, regulatory support, and deep customer relationships.

FY25 was a transformational year for Lupin Manufacturing Solutions. LMS conceptualized a multi-year growth strategy, enhanced its infrastructure, and sharpened its go-to-market approach to emerge as a differentiated CDMO partner. LMS is now equipped to deliver end-to-end solutions for global pharma innovators. Through API Plus and LMS, Lupin is not only ensuring secure global supply chains, but also elevating India’s stature in the global API and CDMO landscape.

Refer to the API section on page 52 for comprehensive business, operational, and regulatory updates.

Outlook

As we look ahead to FY26 and beyond, we do so with confidence, clarity, and commitment — to our purpose, to our patients, and to our stakeholders. The global pharmaceutical industry is poised for growth, being at the intersection of both disruption and opportunity. Structural trends, from the rise of specialty and complex generics, to digital health integration, to the localization of global supply chains, are redefining the delivery, access, and holistic experience of healthcare. At Lupin, we believe that these changes demand not only agility but also intention. Our FY25 performance was not just about delivering numbers; it was about setting the stage for long-term, purpose-led growth.

In India, we see continued headroom for expansion, particularly in chronic therapies, branded generics, and adjacent healthcare services. Our focus in FY26 will be on deepening leadership in high-burden categories, scaling our OTC and diagnostics businesses, and accelerating digital health offerings that can meaningfully improve care outcomes. We are equally focused on expanding our neuro-rehabilitation network through Atharv Ability, responding to a vast and underserved need.

In North America, we are strategically positioned to grow with a robust complex generics pipeline, a strong respiratory franchise, and improving market dynamics. Our focus will remain on high-barrier launches, building further resilience into our supply chain, and expanding our complex generics portfolio.

Our Europe and Australia businesses are expected to maintain stable growth, with additional upside from regulatory approvals and tender wins. In emerging markets, we aim to deepen our presence in South Africa, Mexico, and Southeast Asia through localized offerings and public health partnerships.

Across the business, we will continue to embed ESG, technology, and operational excellence. We are progressing well on our decarbonization and water positivity goals, transitioning to green chemistry practices, and scaling energy-efficient infrastructure. Our investments in automation and GenAI are delivering early wins across research, manufacturing, and commercial analytics.

FY26 will also see us intensify our people agenda — building frontline capabilities, developing future leaders, and creating a workplace culture anchored in inclusion, well-being, and performance.

We recognize that challenges will persist, from price pressures and regulatory shifts to talent competition and climate risk. Yet, our purpose gives us direction. Our strategy gives us resilience. And our execution gives us momentum.

We enter the next fiscal with the clear belief that in a world where healthcare is evolving faster than ever, Lupin will not only keep pace, we will lead with impact.

Risks and Concerns

In an environment marked by accelerating change, resilient and responsible risk management is not an operational backroom, it is a boardroom priority. At Lupin, our purpose-driven growth is anchored in a proactive, enterprise-wide approach to identifying, assessing, and mitigating risks that could impede strategic progress or stakeholder trust.

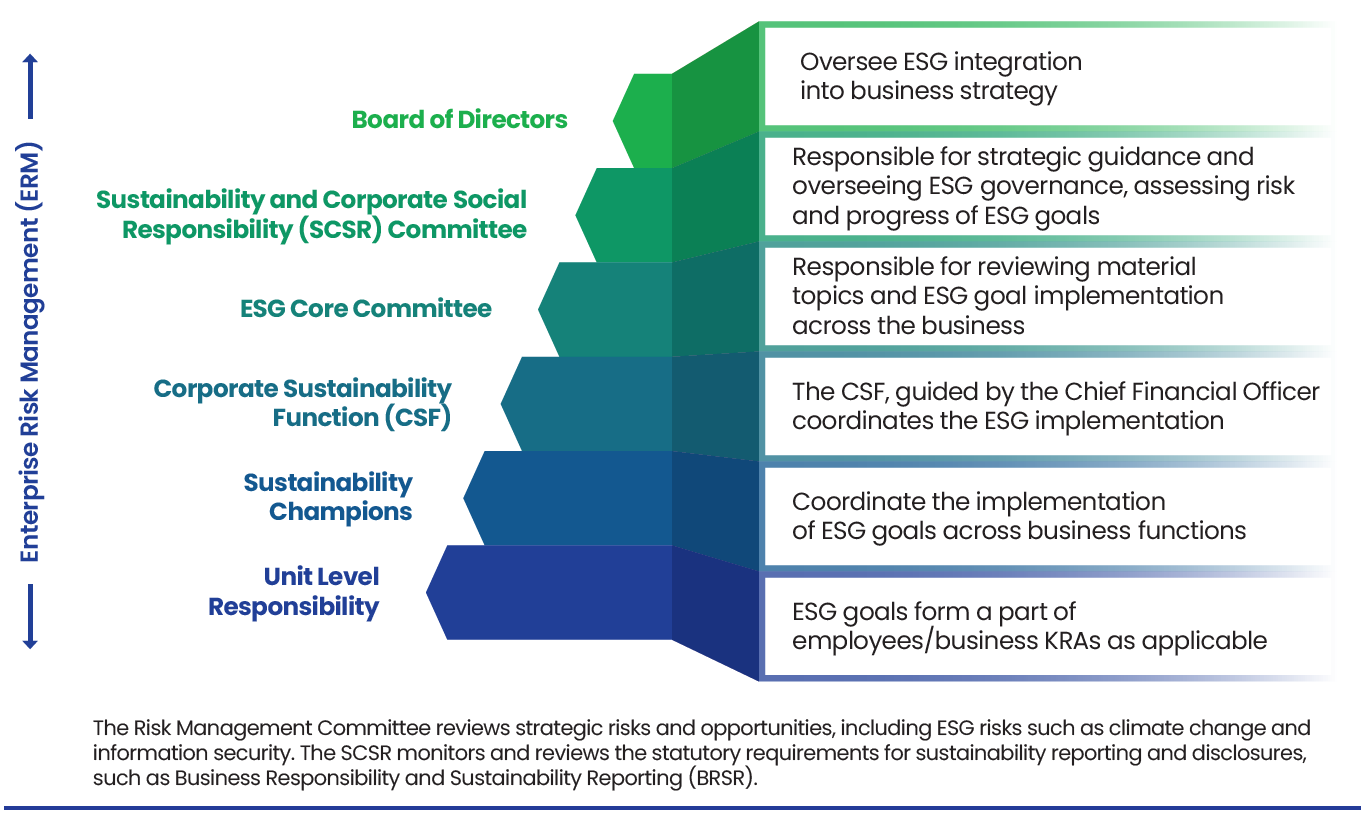

Our Enterprise Risk Management (ERM) framework is designed to integrate seamlessly across business units, geographies, and decision-making layers. Overseen by our Risk Management Committee and reviewed periodically by the Board, the framework incorporates both top-down strategic risk prioritization and bottom-up operational assessments. We leverage real-time monitoring, cross-functional collaboration, and scenario planning to stay ahead of emerging threats.

Risks Categorization

Lupin recognizes that the nature and magnitude of risks will continue to evolve, shaped by macroeconomic uncertainty, patient expectations, regulatory innovation, and climate imperatives. Our risk radar integrates traditional, financial, and compliance risks with emerging ESG, geopolitical, and AI-linked risks.

We are also expanding our risk analytics capabilities, embedding real-time dashboards, and building predictive models to anticipate shifts before they materialize. Our cross-functional Risk Management Council plays a critical role in surfacing early signals and aligning business responses.

We believe that true resilience is not just about bouncing back, it is about building a better tomorrow. Our ability to turn risk into foresight, and foresight into action, is a key differentiator, as we pursue sustainable value creation for all stakeholders.

Read more about Lupin’s risk portfolio and mitigation strategies in the Enterprise Risk Management chapter on page 134.

Internal Control Systems and Their Adequacy

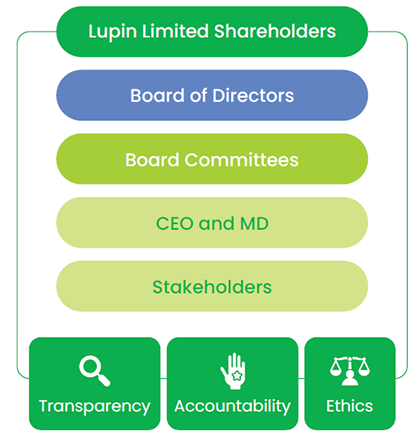

At Lupin, governance is not an adjunct; it is the very framework through which we deliver performance, build trust, and uphold our purpose of catalyzing treatments that transform hope into healing. Our internal controls reflect this ethos. They are embedded into the fabric of our operations, designed not just to safeguard assets and ensure regulatory compliance, but to instil accountability, transparency, and principled decision-making at every level of the enterprise.

Our internal control system is aligned with global best practices, ensuring comprehensive coverage across financial reporting, operational efficiency, compliance management, and ethical conduct. These controls are not static. They evolve continuously, shaped by the operating environment, stakeholder expectations, and emerging risks.

Our Board of Directors, through the Audit Committee and Risk Management Committees amongst others, exercise oversight on the adequacy and effectiveness of internal controls. Independent and experienced, these committees are supported by a risk-based internal audit function that evaluates critical business processes, financial systems, IT infrastructure, compliance protocols, and ESG governance practices. These audits are conducted across geographies and business units, with findings reported directly to the Audit Committee.

Ethical conduct is equally central to our internal control philosophy. Our Code of Business Conduct and Ethics serves as the moral compass of the organization. It is supported by a globally accessible and confidential Ombudsperson platform and whistle-blower mechanism, both of which empower employees to report grievances or suspected violations without fear of retaliation.

We have also institutionalized governance over ESG-related controls through a multi-tiered structure — from the Board-level SCSR Committee to the ESG Core Committee, comprising key executive leaders. This structure ensures that ESG risks, including climate, data privacy, and human rights, are embedded into business operations and disclosure systems.

Lupin will continue to strengthen this foundation by integrating predictive analytics, AI-driven risk flags, and global regulatory mapping tools. Our aim is to not only comply, but to lead, to be a benchmark for control excellence, ethical conduct, and value-based governance in global healthcare.

For more details, read the Governance, Ethics and Compliance chapter on page 54.

Financial Performance

FY25 marked a year of robust financial performance for Lupin, underpinned by disciplined execution, operational excellence, and prudent capital allocation. Our consolidated revenues grew 13.5% year-on-year to INR 227,079 Mn, with EBITDA rising 39.4% and Profit Before Tax (PBT) increasing by 65.8%. This strong performance reflects the seamless alignment between our financial strategy and operational capabilities across markets, therapies, and adjacencies.

Our North America business, driven by complex generics and respiratory products, contributed significantly to revenue and margin expansion, validating our differentiated pipeline strategy. Our India region maintained solid momentum in chronic therapies and scaled new verticals such as diagnostics. Operationally, improvements in product mix, pricing power in niche categories, and portfolio rationalization enabled healthier gross margins across both developed and emerging markets.

Lupin’s focus on cost optimization and supply chain agility delivered tangible results. Operating leverage improved across key manufacturing sites due to higher capacity utilization, while digitization of batch tracking and commercial operations further enhanced predictability and speed-to-market. These efficiencies further contributed to improvements in EBITDA margins compared to the previous financial year.

Research and development investments stood at INR 17,672 Mn, representing 8.0% of revenues (or sales), underscoring our continued commitment to innovation-led growth. Strategic investments in respiratory, complex injectables, and biosimilars are expected to yield long-term returns, especially in regulated markets.

Our Return on Capital Employed (ROCE) improved substantially to 21.6%, reflecting efficient asset utilization, a leaner working capital cycle, and strong operational cash flows. Net Debt to Equity of (0.02) reinforced our balance sheet strength, enabling us to fuel growth through both organic and inorganic means.

In summation, FY25 was not just a year of financial outperformance — it was a demonstration of how purpose-aligned execution, strategic clarity, and operational rigor can drive sustained value creation for all stakeholders.

Read more details on our financial performance in the Financial Capital chapter on page 68.

Material Developments in Human Resources

Lupin’s human capital strategy in FY25 was anchored in creating a future-ready, inclusive, and high-performance organization. We continued to invest in building talent pipelines, enhancing workforce well-being, and fostering a culture rooted in purpose, collaboration, and accountability.

As of March 31, 2025, Lupin employs over 24,000 people globally, spanning manufacturing, commercial, R&D, and enabling functions. Over 1.25 Mn learning hours were clocked across digital, classroom, and experiential formats — reinforcing our focus on upskilling and capability building. Leadership development continued to be a key thrust area, with differentiated programs curated for frontline managers, mid-level talent, and executive leaders.

Lupin also accelerated its Diversity, Equity, and Inclusion (DEI) journey in FY25. Targeted efforts led to 10.4% representation of women in the global permanent workforce. Dedicated mentoring circles, and gender-neutral hiring practices have contributed to making Lupin a more equitable workplace.

In parallel, our safety culture was reinforced across manufacturing sites, with the Total Recordable Injury Rate improving year-on-year, setting new benchmarks for the organization.

Industrial relations across all our manufacturing locations remained cordial and stable. Regular dialogues with union representatives, fair employment practices, and grievance redressal mechanisms, ensured a collaborative environment. We also continued to engage deeply with employees across levels through virtual town halls, skip-level connects, and feedback forums, strengthening trust and alignment with organizational priorities.

As we look to the future, Lupin remains committed to nurturing a culture where every individual is valued, empowered, and inspired to catalyze treatments that transform hope into healing. Read more in the Human Capital chapter on page 92.

Key Financial Ratios

As required under Schedule V of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the details of significant changes (i.e., change of 25% or more compared to the immediately preceding financial year) in key financial ratios, along with explanations, are provided in the Note 64 of the Standalone Financial Statements.

Disclosure of Accounting Treatment

The financial statements for the year ended March 31, 2025, have been prepared in accordance with the Indian Accounting Standards (Ind AS) notified under Section 133 of the Companies Act, 2013, read with the Companies (Indian Accounting Standards) Rules, 2015, and other relevant provisions of the Act.

There has been no deviation from the prescribed accounting treatment in the preparation of these financial statements. All accounting policies have been applied consistently and are in line with applicable Ind AS requirements, ensuring a true and fair view of the company’s financial performance and position.

8th

Rank in IndianPharma Market

34%

Contribution to Lupin's Global Turnover5

Lupin Brands Rank in Top 300 BrandsIn the dynamic and rapidly evolving Indian market, Lupin has continued to demonstrate resilience and strategic focus. In FY25, our India business achieved revenues of INR 75,773 Mn, accounting for 34% of Lupin’s global turnover. This performance reflects our commitment to high-growth chronic therapeutic segments and our purpose-driven approach. With a market share of 3.4%, Lupin now ranks as the 8th largest company in the Indian Pharmaceutical Market (IPM).

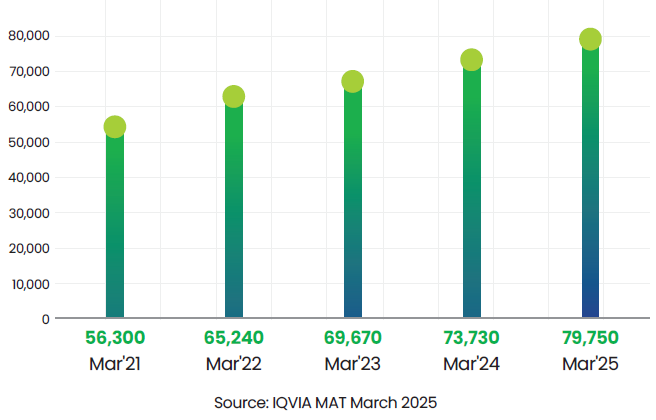

India Formulation Sales* (in INR Mn)

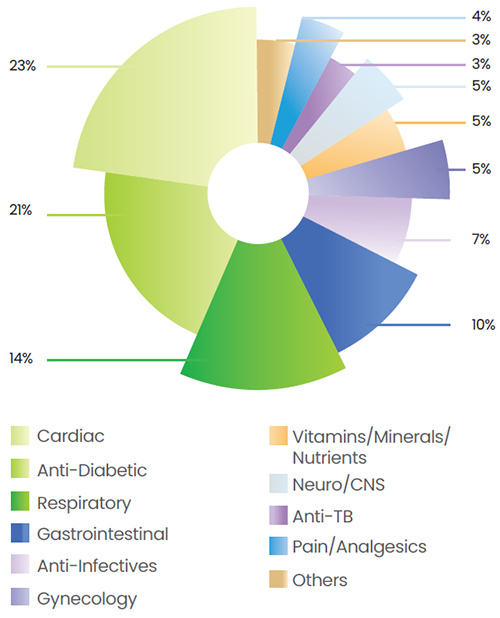

Lupin’s India Region Formulations (IRF) business continues to demonstrate strong performance, with a strategic focus on the chronic segment, which contributes to 63.1% of total IRF revenues. Within the chronic therapy space, Lupin ranks fifth, positioning it as a key player. The company’s top five therapy areas — cardiology, anti-diabetes, respiratory, gastrointestinal, and anti-infectives, collectively account for 74.5% of its domestic sales.

Lupin maintains market leadership in the Anti-TB segment, holds the second position in respiratory, and ranks third in both anti-diabetes and cardiology. The cardiology segment generated revenues of over INR 18,416 Mn, with a growth rate of 12.6%, outperforming the market’s 11.7%. The anti-diabetes segment contributed INR 16,510 Mn, growing at 10.6% compared to the market rate of 8.2%. The respiratory segment clocked in INR 11,439 Mn, a growth rate of 5.1%, ahead of the market at 3.4%. The gastro + hepato segment is rapidly emerging as Lupin’s fourth big therapy area and crossed INR 7,641 Mn in revenues. These numbers highlight Lupin’s strong execution capabilities, therapeutic depth, and ability to drive sustained growth.

Therapy-Wise Share of Revenues

Our purpose of catalyzing treatments that transform hope into healing is integrated into all our activities, ensuring we strive to enhance access to quality healthcare. Lupin’s commitment to fostering stronger connections with Healthcare Professionals (HCPs) and driving better patient outcomes is evident through its innovative initiatives.

In FY25, our cardio-diabeto portfolio surpassed the market growth, reflecting continued prescriber confidence and the strength of our differentiated offerings. Despite a market slowdown, our respiratory therapy sustained demand. These results underscore the quality of our portfolio as well as the trust we have established with over 250,000 healthcare professionals.

Lupin’s Focused Therapy-Wise Ranking

| Rank | 1 | 3 | 3 | 2 | 9 | 6 | 10 |

|---|---|---|---|---|---|---|---|

| Therapy | Anti-TB | Anti-Diabetic | Cardiology | Respiratory | Gynecology | Neuro/CNS | Gastrointestinal |

| Market Share | 61.3% | 8.0% | 6.1% | 6.2% | 3.6% | 2.7% | 2.7% |

Brand building continues to be the crux of our long-term growth strategy. Our sustained investments in brand development continue to deliver meaningful outcomes. Five of our flagship brands — Gluconorm-G®, Budamate®, Huminsulin®, Ivabrad®, and Rablet-D® — are ranked in the IPM Top 300. In FY25, 19 brands were featured in the IPM Top 500 and 17 brands have joined the INR 100-crore club, with the addition of 5 new brands. These milestones reflect more than commercial success; they underscore the enduring relevance of our portfolio, the trust we have gained from prescribers, and our consistent execution across therapeutic areas.

Every brand in our portfolio is supported by a disciplined, data-driven approach to medical engagement, strong retail availability, and targeted digital outreach. These efforts are designed for dual outcomes – driving prescription growth and building brand equity, ensuring our therapies remain trusted, relevant, and accessible across India.

This year, strategic acquisitions further reinforced our leadership in diabetes management. The addition of Huminsulin® from Eli Lilly, along with Gibtulio® and Ajaduo® brands from Boehringer Ingelheim, has enabled us to offer comprehensive solutions throughout the diabetic patient journey. Additionally, our expansion into Tier 2 and Tier 3 cities has resulted in improved access to chronic and acute therapies in underserved regions.

A key driver of Lupin’s commercial excellence is our strong field force — one of the most agile and digitally enabled teams in the industry. Their ability to engage healthcare professionals with precision, timeliness, and insight sets us apart. We consistently implement targeted interventions with our sales team to enhance productivity, responsiveness, and scientific engagement.

Platforms such as SmartRep, SmartBuddy, and Sahayak have redefined operational efficiency, offering integrated analytics, personalized planning, and seamless query resolution. These tools empower our representatives to deliver high-impact, value-driven interactions that strengthen prescriber relationships and contribute to improved patient outcomes. By continuously investing in digital capabilities and frontline enablement, Lupin ensures its field force remains a strategic asset — driving growth, deepening trust, and reinforcing our leadership across therapeutic areas.

At Lupin, our business is anchored in meaningful engagement with both healthcare professionals and patients. Strengthening these relationships is central to our mission of advancing health outcomes. We remain deeply committed to supporting medical practitioners through innovative scientific platforms that foster global academic collaboration, promoting the exchange of advanced insights, and ensuring that specialists remain at the forefront of clinical practice.

Lupin is committed to being a patient-centric organization – our patients are at the heart of all our initiatives. Our patient support programs reflect our purpose-driven approach. In FY25, over 100,000 patients were onboarded in the HuMrahi program, more than 30,000 enrolled under JAI, and thousands benefited from AI-enabled breast cancer screening with our partnership with Niramai. By going beyond the prescription, we are building holistic ecosystems that enhance adherence, raise awareness, and deliver measurable improvements in patient outcomes.

Patient Support Programs

HuMrahi

HuMrahi, Lupin’s patient support program for diabetes and cardiac conditions, supported over 100,000 patients in FY25. Endorsed by the famous cricket captain Kapil Dev, it features 200+ diabetes educators, personalized counseling, health monitoring tools, free medication and tests and is available in 12 languages. Through HuMrahi, we conducted 10,000+ camps, screened 75,000 individuals, improving chronic disease management across India.

SAARTHI - Say Yes to Life

SAARTHI, a support program for mental health professionals and patients under the Say Yes to Life campaign, offers multi-lingual support across India. It enables psychiatrists to deliver consistent care, fosters open patient-doctor dialogue, and provides tools to manage anxiety, stress, and other conditions, empowering improved treatment outcomes and enhanced mental well-being.

Joint Airways Initiative

Lupin’s Joint Airways Initiative (JAI), India’s first digital asthma educator platform, guides patients on correct inhaler use and disease management. With India having 13% of global asthma cases and high asthma mortality rates, JAI is essential, and we have enrolled over 30,000 patients to date.

AI Screening for Breast Cancer

Lupin’s breast cancer screening initiative, partnered with Niramai, uses AI-based Thermalytix™ for early, noninvasive detection. It has 70% higher accuracy than manual thermography. A total of 65 camps were conducted in FY25, screening 2,500 women across the country. This internationally certified program enhances Lupin’s oncology diagnostics and expands healthcare access.

NovaShakti

NovaShakti empowers women against heart disease through awareness, timely diagnosis, and access to care. Through impactful programs, NovaShakti has reached over 25,000 patients, engaged over 6,000 healthcare professionals, and screened over 2,000 women. Partnering with Indian boxer and Olympian MC Mary Kom, NovaShakti promotes women’s heart health awareness. Active on Facebook, LinkedIn, X, and Instagram, NovaShakti fosters a community committed to improving women’s heart health across India.

Prothsahan

Prothsahan, Lupin’s flagship breast cancer awareness program, emphasizes early detection and community education. Partnering with renowned women like Kiran Bedi, Chhavi Mittal, and Mahima Chaudhary, it has engaged communities through expert-led Facebook Live sessions over three years. Prothsahan showcases stories of survivors and treatment insights to promote timely interventions and improve health outcomes.

LivAlert Campaign

Lupin’s LivAlert campaign, launched in 2021, focuses on promoting liver health in India, a country where one in three individuals is affected by liver-related issues. The Screen- Detect-Treat initiative tested over 130,000 patients and engaged 1,200 healthcare professionals across 11,000+ camps. The new Liver Profile Check targets high-risk groups for early intervention.

Our commitment extends beyond therapeutic leadership — it’s about transforming lives through equitable access, deep patient engagement, and purpose-driven innovation. Every initiative brings us one step closer to a healthier, more inclusive world.

Rajeev Sibal, President — India Region Formulations

Accelerating Digital Transformation for Scalable Impact

Digital innovation continues to be a key enabler of Lupin’s strategy to improve healthcare access and patient outcomes. We are leveraging advanced technologies to empower both our field representatives and healthcare professionals, fostering meaningful engagement and equitable access across our stakeholder ecosystem.

Our omnichannel platforms — Lupin Connect, DigiEngage and GP Konnect, facilitate seamless multichannel engagement with HCPs, integrating digital tools and telecommunication. These platforms serve as strategic touchpoints beyond traditional sales channels, offering timely access to educational content, therapeutic updates, and clinical guidelines. This knowledge-driven engagement empowers HCPs with evidence-based insights to deliver optimal patient care.

Collectively, our omnichannel strategies have extended reach to over 100,000 healthcare professionals, demonstrating the tangible impact and scalability of our digital engagement model.

SmartRep has emerged as the digital backbone of our sales force. With 98% adoption across our divisions, it integrates performance tracking, coaching modules, a centralized knowledge hub, and appraisal systems. This helps us deliver integrated, actionable insights that boost field efficiency.

Last year we introduced Sahayak, a query management system for our sales team, embedded within SmartRep. In FY25, over 11,000 queries were resolved with a 95% resolution rate. Sahayak has played a pivotal role in enhancing operational responsiveness and streamlining our internal workflows.

Taking digitization further, we launched SmartBuddy — India’s first generative AI-powered assistant for pharmaceutical field teams. Integrated into SmartRep, SmartBuddy offers personalized call planning, coverage analytics, and medical information support, forming a unified, intelligent ecosystem alongside SmartRep and Sahayak.

Last year, we advanced our AI-powered healthcare chatbot with the launch of Anya 2.0. Powered by generative AI, Anya delivers enriched content across 12 therapy areas and responds in 20 Indian languages. This has made Anya more responsive and interactive to a diverse patient base.

Our internal platform, Lupin Gurukul, functions as a centralized hub for marketing collaterals and support materials. It streamlines access to critical resources, enhances cross-functional collaboration, and accelerates decision-making.

Our growing social media presence further reflects our commitment to digital engagement. In FY25, our HCP-focused handle, Lupin India, grew by 12%, while our patient-focused handle, Shaping Health, saw a 14% increase in followers.

India Adjacencies

LupinLife Consumer Healthcare

LupinLife, our consumer healthcare arm, continues to chart a strong growth trajectory, delivering science-backed, trusted wellness solutions that align with India’s evolving healthcare preferences. As a key adjacency to Lupin’s prescription business, LupinLife represents our pivot toward holistic, Over-The-Counter (OTC) care.

Since its inception in 2017, LupinLife has evolved into a diversified multi-brand portfolio addressing gastro, health supplements, women’s health, and pain management. Our focus continues to be on capitalizing market opportunities through robust growth that surpasses the market. This is achieved by enhancing consumer relevance, enabling agile execution, and demonstrating strong operational excellence.

Softovac®, our flagship brand, maintained its market leadership in the bulk laxatives category with a commanding 42% market share. The brand has doubled in size over the past five years, accelerated by product innovations such as Softovac Liquifibre®, a liquid fibre formulation, which earned the “Best Impact Creator in Healthcare” title at the Big Impact Awards 2025.

In the children’s health category, Aptivate® made a notable impact. Despite category decline, Aptivate® performed well, leveraging high-impact activations like the Aptivate Achhi Bhook Quiz, which deepens emotional engagement with parents and children.

Strategic health supplement brands — Corcium®, Corcium D3®, and Beplex Forte®, are undergoing structured consumerization, strengthening our wellness footprint and driving scale.

Recognizing the strategic potential of the OTC segment, we have initiated the carve out of this business into a wholly owned subsidiary of Lupin — LupinLife Consumer Healthcare Limited. This structural shift enhances operational autonomy, accelerates portfolio innovation, and unlocks sharper consumer focus for sustainable future growth.

Lupin Diagnostics

India’s healthcare ecosystem is undergoing a paradigm shift, and diagnostics is emerging as the cornerstone of preventive and personalized care. With a burgeoning middle class and greater health awareness, the demand for reliable, accessible diagnostic services is intensifying. In this market, Lupin Diagnostics continues to scale by delivering trusted, high-quality diagnostic solutions.

Launched in December 2021 with our National Reference Laboratory (NRL) in Navi Mumbai, Lupin Diagnostics has a growing pan-India presence. Today, we operate 44 processing labs across the West, East, and South of India, servicing over 250 cities including Metros, Tier 1, Tier 2, Tier 3, as well as Tier 4 cities. Lupin Diagnostics’ revenues grew by 89% CAGR over its three years of operations, and we now serve more than 150,000 patients every month.

Quality remains the backbone of our diagnostics operations. All our greenfield labs are NABL accredited, a distinction held by just 3.8% of labs nationwide. Our state-of-the-art 45,000 sq. ft. National Reference Laboratory in Navi Mumbai, is equipped with cutting-edge instruments such as the Affymetrix Gene Chip Scanner, AI-based Robotic Karyotype Machine, Ion Torrent NGS platform, Fully Automatic Ventana, and AutoDELFIA.

With 70% of clinical decisions in India relying on diagnostic inputs, Lupin Diagnostics plays a pivotal role in driving accurate diagnosis and optimized treatment. We continue to expand our offerings in high-impact segments including oncology, neurology, and genomics, making advanced testing accessible even in Tier 3 and Tier 4 towns.

With 750+ collection centers and a strong home collection network, we are enhancing last-mile access to quality diagnostics. Our smart reports, featuring trend analytics and preventive health tips, empower patients to take charge of their health.

Understanding that over 90% of diagnostic errors occur in the pre-analytical phase, we ensure temperature-controlled sample logistics through 200+ trained field executives, safeguarding sample integrity and result reliability.

Lupin Diagnostics stands at the intersection of clinical excellence, digital innovation, and social relevance. As we scale this adjacency, we remain committed to delivering trusted best-in-class diagnostic care, anchored in accuracy, accessibility, and impact.

Lupin Digital Health

Lupin Digital Health (LDH) is shaping the future of cardiovascular care in India through its pioneering digital therapeutics platform. As the country faces an escalating burden of cardiovascular and metabolic diseases, LDH is extending the reach of care beyond hospital walls — delivering clinically validated, technology-enabled, and personalized treatment pathways to patients across the nation.

At the heart of LDH’s offering is LYFE®, our flagship digital platform designed for patients with coronary artery disease, acute coronary syndrome, heart failure, or valvular heart disease. Today, LYFE® reaches over 380 Indian districts, integrating clinical expertise, remote monitoring, behavioral support, and digital care coaches to offer continuous, outcome-driven care.

In FY25, LDH expanded its portfolio by launching a closed beta launch for a new prevention-focused platform, targeting individuals at risk of cardiometabolic diseases such as hypertension, type 2 diabetes, dyslipidemia, and obesity.

Strategic collaborations defined LDH’s progress this year. The LYFE® platform has been integrated into a leading insurer’s digital ecosystem, expanded through post-discharge programs with private insurers and hospital networks, and further embedded into patient journeys through a new partnership with a leading player in the surgical segment.

This focused execution reinforces LDH’s role as a complementary force to Lupin’s chronic care engine. To elevate patient experience and scientific credibility, LDH collaborated with the American College of Cardiology to develop home care workbooks tailored for India and published nine peer-reviewed articles over the year.

Quality remains non-negotiable and LDH earned the ISO 13485:2016 and ISO 27001:2022 certifications for its medical device quality and information security management systems respectively, and the LYFE® platform was approved as a Class C Software as a Medical Device by the regulator, CDSCO.

Lupin Digital Health is not merely innovating — it is transforming. By embedding empathy into algorithms and technology into care, LDH is advancing chronic disease management in ways that are scalable, sustainable, and human-first. As India’s digital health landscape evolves, LDH stands poised to redefine the way chronic care is delivered and experienced.

Atharv Ability

Atharv Ability, Lupin’s flagship neurological rehabilitation initiative, represents bold and compassionate strides toward redefining care for patients with neurological disabilities. Established with its first center in Mumbai, Atharv Ability is a state-of-the-art outpatient facility delivering customized, multidisciplinary therapy for adults and children affected by serious neurological conditions — anchored in global clinical best practices.

Rehabilitation is a critical, yet underserved pillar of neurological recovery, especially in India. Atharv Ability addresses this need gap with a comprehensive approach that has consistently delivered measurable outcomes — 30-40% improvement in functional recovery and quality of life across patient cohorts. In a country with limited integrated neuro-rehab offerings, Atharv Ability bridges the care gap for a wide spectrum of conditions such as stroke, traumatic brain injury, spinal cord injury, Parkinson’s disease, cerebral palsy, multiple sclerosis, and various pediatric neurological disorders.

Atharv’s treatment architecture is built on clinical depth and technological precision. The center houses advanced therapies including neurophysiotherapy, robotic rehabilitation, speech and occupational therapy, cognitive therapy, aqua therapy, spine and pain management, pediatric neurological rehabilitation, and training for activities of daily living — all within a unified care ecosystem.

FY25 marked a significant year of progress. Atharv Ability treated over 2,800 patients and delivered nearly 40,000 sessions, comprising 12,500+ neurophysiotherapy, 7,200+ robotic therapy, and 2,200+ aqua therapy sessions. Many patients, once dependent on wheelchairs, regained mobility and independence — transforming not just clinical outcomes, but lives and families.

Atharv Ability also expanded its footprint with the opening of a new, state-of-the-art center in Hyderabad, marking the beginning of an expansive growth strategy. This expansion underscores our belief that high-quality neuro-rehabilitation must be accessible, affordable, and standardized across India.

Atharv Ability is a tangible expression of Lupin’s purpose — to catalyze treatments that transform hope into healing. It exemplifies our ambition to go beyond treatment and restore ability, dignity, and self-reliance to each patient we serve. As we look ahead, Atharv Ability is poised to scale its model across geographies, setting the benchmark for neuro-rehabilitation in India.

Lupin Life Sciences

Lupin Life Sciences (LLS), our trade generics business unit, was formally carved out of Lupin Limited as a wholly owned subsidiary in July 2024, marking a pivotal step in our strategic roadmap. This move enables sharper operational focus, speed, and execution agility in a high-potential segment that is expected to grow at 12%–15% CAGR over the next five years.

The year was transformative, marked by a renewed strategic approach, country-wide organizational expansion, and the integration of two divisions to streamline operations and boost efficiency. Today, LLS offers a robust portfolio of 350 products, spanning across pain and analgesics, anti-infectives, gastrointestinal care, multivitamins, respiratory care, and dermatology — each meeting high-quality standards and offered at accessible prices.

With the new strategic approach, LLS’ efforts are now directed toward driving demand generation at the last mile. A strong field force, deeper chemist engagement, and focused brand level strategies will help the business create a strong base and execute on its long-term objective. LLS is set to become a market shaper in India’s evolving trade generics landscape and poised to deliver high double-digit growth in FY26 and beyond.

3rd

Largest Generics Company (by filled prescriptions)50

Products Rank #1 in the U.S. (in respective categories)3rd

Rank by Generic Respiratory Sales (in the U.S.)North America remains a cornerstone of the global pharmaceutical industry, driven by its market scale, scientific leadership, and innovation ecosystem. As the U.S. and Canadian healthcare systems evolve in response to policy, pricing, and supply chain realignments, Lupin remains well-positioned to capitalize on emerging opportunities across both generics and specialty segments. Our strategic focus, deep pipeline, and commitment to catalyze treatments that transform hope into healing, underpin our growth ambitions in this region.

United States

United States

The U.S. pharmaceutical market is the largest in the world, with a net value of USD 487 Bn in 2024, and is expected to grow at a CAGR between 3% and 6% from 2025 to 2030

This is one of the few developed markets likely to experience both population growth and an ageing demographic through 2030, making it attractive for the delivery of innovative, affordable treatment options. At the same time, the market is undergoing a period of significant transformation, shaped by a complex interplay of geopolitical dynamics, regulatory shifts, and evolving healthcare policies. For Lupin, these developments constitute both headwinds as well as meaningful strategic opportunities to strengthen our leadership in the market. While challenges remain, the U.S. continues to be a critical driver of pharmaceutical innovation and a key pillar of Lupin’s future growth.

As the U.S. market evolves, Lupin is poised to lead with patient-centricity and a well-balanced portfolio. Our generics and complex generics don’t just drive our business — they advance our deeper purpose: expanding access to high-quality care for millions.

Spiro Gavaris, President – U.S. Generics

U.S. Generics Business

Lupin continues to be the 3rd largest generic pharmaceutical company in the U.S. (by prescription), with a market share of 4.9%. Out of the 138 products marketed by Lupin in the U.S., 50 products rank #1 and 105 products rank among the top 3 in their respective categories. Continuous improvements in key operational and customer service metrics, backed by strong commercial execution, have enabled Lupin to be a partner of choice. By leveraging our robust portfolio and guided by our purpose, we positively impact the lives of over 60 Mn patients across the U.S.

Our U.S. business performed exceptionally well across all dimensions, making solid top- and bottom-line impact. The business grew double digit in FY25 compared with the previous year and continues to contribute more than a third of Lupin’s overall revenues. The delivery and launch of key pipeline products formed the bedrock of this solid growth. Notably, during the year we launched seven new products, including Mirabegron, Doxycycline Capsules, and Prednisolone. Building on our momentum, we launched Tolvaptan with 180-day exclusivity in the beginning of FY26 — a specialized product commercialized through specialty channels.

Our increasing focus on complex generics, including inhalation and injectables over the past five years, is yielding significant benefit. Complex generics now account for 35% of our U.S. revenues, and with the robust pipeline we have built, this is projected to reach 49% by FY30. This strategy has helped us navigate the challenging pricing environment that impacts oral solids.

Our inhalation portfolio comprises of metered-dose inhalers (MDIs), dry-powder inhalers (DPIs) and nasal sprays. This helps build our strong position in the generic respiratory care market in the U.S., where we rank #3 by respiratory sales among generics companies. Our Albuterol and Tiotropium products continue to drive revenues and provide accessible, affordable, and high-quality options to millions of Americans. Other dosage forms, including oral formulations Lisinopril, Gx Suprep®, and Gavilyte®, also continue to contribute meaningfully to our revenues.

On the manufacturing front, our facility in Somerset, NJ, received an EIR from the U.S. FDA — a testament to our ongoing commitment to regulatory excellence and strengthening of U.S. operations.

Specialty Business

Our U.S. Specialty business took material steps this year, aiming to build profitably while staying true to patient care. We divested Solosec to Evofem in July 2025, allowing us to sharpen our focus on our Asthma and COPD brands — Xopenex HFA® and Brovana®. In particular, Xopenex HFA® and its authorized generic saw double-digit growth in both volume and sales, driven by steady supply and smart marketing.

In addition, over the year, our specialty segment formed strong partnerships through volume-based contracts with leading retail pharmacy chains.

Outlook

As we look toward FY26, Lupin’s U.S. business stands ready to grow with heart and purpose. Backed by a robust portfolio of generics, complex generics, and specialty products, our focus remains on new product launches in strategically important areas of the market. By FY30, we aim to launch 100+ new products, with a significant portion featuring Para IV filings and First-to-File/Market opportunities, which will assure healthy topline and bottom-line growth.

Canada

Canada

The Canadian pharmaceutical market is valued at USD 33.4 Bn and grew by 8% this year (Source: IQVIA CDH Database), fueled by biologics and diabetes/anti-obesity drugs. Lupin Pharma Canada Ltd., our Canadian subsidiary, specializes in gastroenterology and women’s health brands, as well as niche and complex generics. Since our foray into this market in 2015, the business has consistently grown by double-digits each year, reflecting an 18% CAGR between FY20 and FY25. 60% of this business is driven by our specialty focus, and key products in this market include Zaxine®, Relistor®, and Intrarosa®. To expand our specialty focus we recently acquired Nalcrom® from Sanofi and in-licensed three brand products for Attention-Deficit/Hyperactivity Disorder (ADHD).

We are focused on expanding our portfolio of complex generics in this market. The approval of Tolvaptan as the first generic in April 2025 is an example of our dedication to introducing complex and specialty generics. Today, we are among the few generic companies to receive an approval from Health Canada for inhalation products with the approval and successful commercialization of Tiotropium.

The inhalation generic pipeline presents a significant opportunity for future years. This aligns with our vision of being a global leader in the respiratory area.

We are building a future of focused growth. Every brand, every program we pursue, is a reaffirmation of our belief in therapies that matter and care that transforms.

Claus Jepsen, President — Global Specialty

Way Forward

North America remains a cornerstone of Lupin’s global strategy. In the U.S., our leadership in generics and a sharpened focus on complex and specialty therapies continue to deliver strong growth. In Canada, our differentiated portfolio and consistent double-digit growth further reinforce our capabilities in high-potential therapy areas. With a strong pipeline, focused execution, and deep-rooted purpose, we are confident of sustaining and expanding our leadership in this strategically critical region.

11%

of Lupin’s Global Revenues230,000

Patients in the U.K. use Luforbec® Every Month4th

Largest Generics Player in AustraliaOur other developed markets comprising of Europe and Australia are mature and highly regulated, where differentiation plays a critical role. Our unique blend of niche generics, biosimilars, specialty medications, and complex inhalation products, have been pivotal to our growth in these regions, providing substantial value to patients, healthcare systems, and communities. These markets contribute 11% of Lupin’s global revenues.

Europe

Europe

Europe, valued at USD 366 Bn (IQVIA MAT February 2025), represents one of the largest pharmaceutical markets globally. With generics accounting for over USD 75 Bn and a number of patent expirations, particularly in biologics, the continent presents significant opportunities. In FY25, Lupin’s European operations delivered robust business performance, attributable to a strategic expansion plan and a patient-centric approach.

We expanded the reach of Luforbec® (Beclometasone-Formoterol Gx), our first respiratory product, to numerous countries, providing affordable treatment options and cost saving for public health systems. We also widened access to NaMuscla®, our flagship neurology drug, beyond the U.K., Germany, and France. This growth, combined with the strengthening of our injectable portfolio in France, led to total sales of USD 195 Mn in Europe, reflecting a robust 22% year-on-year growth and a 14% CAGR over the past five years.

NaMuscla® exemplifies our commitment to addressing the needs of those affected by rare and debilitating diseases. It is approved for adults and is specifically designed for patients with non-dystrophic myotonic disorders, a condition with limited treatment options. In FY25, we completed Phase III pediatric trials for patients aged between 6–18 years and filed regulatory submissions with the European Medicines Agency and U.K. MHRA; the launch is expected to take place later in FY26. Simultaneously, we are conducting three new studies to assess the wider capability of NaMuscla® in treating myotonic dystrophy, to support more patients in reclaiming mobility and enhancing their quality of life. We have now partnered with Avas Pharmaceuticals SRL to offer NaMuscla® in Italy, enhancing access to rare disease treatments in Europe.

Our entry into injectables in Europe was marked by the acquisition of Medisol SAS in France. Medisol’s portfolio, including pain relief, anti-inflammatory, and cardiovascular injectables, provides a strong foundation to scale our presence in this category. This strategic move supports our ambition to address gaps in essential hospital and specialty care across European markets.

Germany

Hormosan Pharma GmbH, our wholly owned subsidiary in Germany, continued to demonstrate exceptional performance, achieving strong double-digit growth in FY25.

Hormosan’s portfolio in neurology, pain management, sexual health, and inhalation therapy effectively addresses high-burden conditions, benefitting patients significantly.

A standout product is Tempil®, used for the treatment of severe cluster headaches, a debilitating condition that greatly impairs the quality of life. The consistent availability and efficacy of Tempil® provides patients with relief and a restored sense of normalcy. Luforbec®, our branded Beclometasone/Formoterol inhaler, gained robust traction, achieving a 20% market share by the end of FY25 (IQVIA MAT February 2025). With the upcoming launch of a higher-strength variant in FY26, we aim to provide more options for patients with varying disease severities.

United Kingdom

Lupin Healthcare U.K., our wholly owned subsidiary, strengthened its leadership in the respiratory space. Our flagship inhaler Luforbec®, became the top primary care brand by both value and volume, achieving over 30% market share (IQVIA MAT February 2025). Over 230,000 patients use Luforbec® every month, indicating its widespread utilization within the healthcare system and amongst prescribers.

Our dedication to sustainability remains unwavering. We are proud to provide carbon-neutral inhalers, effectively offsetting emissions from our respiratory portfolio. As we continue to develop next-generation environment-friendly propellants, we aim to safeguard the future of our products while addressing both patient and environmental needs.

Outlook

Looking ahead to FY26 and beyond, we recognize the macroeconomic and geopolitical uncertainties that may shape market dynamics in Europe with inflation, cost pressures, and regulatory and pricing challenges. We remain resolute and committed to our strategy.

The upcoming acquisition of Renascience further strengthens our presence in the branded and pharmacy sectors, complementing our respiratory momentum and positioning us for robust, diversified growth in the U.K.

We will continue to expand our presence across key therapy areas, deepen our specialty care offerings, and build on our core platforms — inhalation, neurology, and injectables. By doing so, we aim to reinforce our leadership, drive sustainable revenue, and deliver lasting value to patients, healthcare systems, and partners across Europe.

As we expand access across developed markets, we do so with agility, empathy, and an unwavering commitment to our purpose: healing. Grounded in therapeutic relevance and guided by proximity to patients, we continue to move forward — together — on our shared mission to catalyze healing.

Thierry Volle, President — EMEA and Emerging Markets

We're building a future-ready organization grounded in ethics and driven by excellence. Every partnership and every product is an opportunity to deliver care that catalyzes healing.

Dr. Sofia Mumtaz, President — Legal and Compliance, Canada, ANZ, and NEA business

Australia

Australia

Australia’s pharmaceutical market, valued at AUD 25 Bn, continues to grow at 3% annually, with the generics segment accounting for over AUD 3 Bn. Lupin’s wholly owned subsidiary, Generic Health, is the fourth-largest generics player in Australia, significantly contributing to our global footprint in developed markets.

Generic Health has recorded a remarkable 20% CAGR over the last five years. This growth has been propelled by our broadening product portfolio and operational agility — through the B2B business and strategic partnerships.

With a population of 27.3 Mn, over 30% of whom are aged above 55 years, Australia represents a healthcare market with high chronic disease burden and rising pharmaceutical needs.

FY25 was a milestone year. We launched 10 new products, expanded our reach through a strategic supply partnership with the Wagner brand, and introduced Prasugrel, strengthening our presence in the cardiovascular segment. Despite heightened competition, our market share for key products experienced sustained growth. A noteworthy highlight was our entry into New Zealand through the establishment of Lupin NZ Ltd., where we will commence both retail and tender-based operations in FY26, marking a new phase for our expansion in the region.

Outlook

Generic Health will continue to focus on biosimilars and niche generics, while expanding into respiratory and oncology therapies. Our entry into New Zealand will be supported by smart partnerships and a differentiated portfolio. Despite competitive pressures for our anchor products, our robust pipeline, dedication to patient-centric innovation, and commercial excellence will help us to sustain momentum and continue to create value for patients, prescribers, and partners across the region.

Way Forward

Lupin’s other developed markets, encompassing Europe and Australia, are strategic pillars of our increasing global presence. These regions offer both scale and sophistication, making them ideal for our differentiated offerings in respiratory care, biosimilars, neurology, and niche generics. As we look to FY26 and beyond, our strategy is threefold: expand access, enhance relevance, and foster resilience.

Across these markets, we are creating agile, ethical, and future-ready organizations with strong local leadership, efficient operations, and patient-focused strategies. We are guided by a single, unifying belief; that every market, every product, and every partnership is an opportunity to catalyze treatments that transform hope into healing. With purpose as our compass, we are ready to navigate market complexities, seize new opportunities, and leave a lasting impact on the lives of the patients we serve.

11%

of Lupin's Global Sales8th

Largest Generics Pharma Company in South Africa3rd

Largest in the Ophthalmic Segment in MexicoLupin’s purpose, to catalyze treatments that transform hope into healing, finds strong expression in our work across our emerging markets, including South Africa, Brazil, Mexico, the Philippines, and our Global Institutional Business (GIB). Each of these markets presents a unique healthcare landscape, and Lupin has responded with tailored, patient-centric healthcare solutions. In FY25, we continued to reinforce our presence and impact through quality generics, new product launches, and strategic partnerships. Together, these markets contributed to 11% of Lupin’s global sales in FY25.

South Africa

South Africa

South Africa remains one of Lupin’s most promising emerging markets, a nation where access to affordable, quality healthcare continues to evolve rapidly. The pharmaceutical market is valued at ZAR 70.3 Bn, growing at 4.4% YoY, with the private market segment contributing ZAR 59.1 Bn, growing at 4.9% (IQVIA MAT February 2025). In this dynamic environment, our subsidiary Pharma Dynamics surpassed industry growth, achieving a MAT growth of 8.8% with sales of ZAR 1,520 Mn in FY25.

This performance was propelled by sustained momentum in our cardiovascular and central nervous system portfolios, despite economic challenges and reimbursement pressures from medical aid agencies. Our OTC franchise also demonstrated strong performance, primarily driven by the success of Efferflu-C® Immune Booster and the Texa Allergy brand.

The acquisition of MNI, a key player in the non-scheduled consumer segment, has helped in expanding our presence in South Africa’s fast-growing, pharmacy-led, self-care market. As primary healthcare access broadens, this acquisition enables us to address the evolving needs of patients more comprehensively.

Today, we are the largest cardiovascular company in South Africa, commanding a 15% value share, with a portfolio of 28 products that are ranked first across key therapeutic categories. We are also the 8th largest generic pharmaceutical company in the country, a strong testament to our growing presence and trust among healthcare stakeholders. In FY25, we secured nine product approvals from the South African Health Products Regulatory Authority, launched six new products, and added nine more through the MNI portfolio.

In line with our commitment to inclusive progress, Pharma Dynamics continues to support the government’s Broad-Based Black Economic Empowerment policy. Our upcoming verification is expected to show improved compliance, driven by new initiatives such as participation in the Youth Employment Service, which fosters employment opportunities for young professionals.

As we look to FY26, we plan to introduce a range of new products, continuing our growth trajectory, and further strengthen our offerings. We are also actively expanding our presence in the OTC self-help (CAMS) category, through organic innovation as well as strategic inorganic opportunities. South Africa remains not just a key market for us, but a canvas where our purpose comes alive.

Brazil

Brazil

Brazil, Latin America’s largest pharmaceutical market and one of the top 10 globally, continues to be a strategic market for Lupin, valued at BRL 295 Bn. Our subsidiary, MedQuímica, has established itself as a trusted partner in Brazil’s healthcare ecosystem, recognized for its commitment to quality, affordability, and reliability. In FY25, MedQuímica achieved net sales of BRL 235 Mn to reach the third position in the retail reference market. Notably, 40% of its revenues were derived from the thriving OTC segment.

Despite macroeconomic pressures and regulatory complexities, FY25 was a year of strategic consolidation and meaningful progress for Lupin in Brazil. MedQuímica launched nine new products across generics, branded generics, and OTC categories, reinforcing its portfolio and patient acquisition. Our rare disease therapy, Cuprimine, significantly strengthened our non-retail offering and delivered encouraging results, expanding our therapeutic footprint.

Operationally, we achieved our highest production volumes in three years, while enhancing productivity and minimizing waste. Through intelligent automation, we fortified our supply chain, ensuring greater responsiveness and resilience. We are now consistently focused on our key segments of OTC, branded generics, and core generics to meet patient needs across the economic and therapeutic spectrum.

In FY26, MedQuímica is poised to build on its strong foundation. We will continue expanding our point-of-sale reach, ensuring greater availability of essential medications. Simultaneously, we will launch new products across metabolic, CNS, CVS, and biosimilar therapies, addressing Brazil’s evolving healthcare needs. Backed by a passionate team and a deep understanding of local needs, we are confident of delivering meaningful growth and long-term impact in Brazil, making quality healthcare more accessible to millions across the country.

Mexico

Mexico

Mexico, with its MXN 218 Bn retail pharmaceutical market growing at 4.3%, stands as the second-largest pharma market in Latin America. Lupin’s subsidiary, Laboratorios Grin, continues to play a pivotal role in this region, recording MXN 941 Mn sales in FY25. This was a breakthrough year for Lupin in Mexico, one defined by resilience, renewal, and growth. Our progress was anchored through excellence in operational agility and supply planning, enabling us to meet market demands.