Our Enterprise Risk Management (ERM) process is designed to identify potential risks, ensure accountability, and support informed decision-making to safeguard the company. Our approach ensures that risk management is integrated into everyday decision-making, thereby strengthening the organization’s resilience and capability to navigate uncertainties, ultimately helping us deliver value to our patients, shareholders, and stakeholders.

Risk Governance

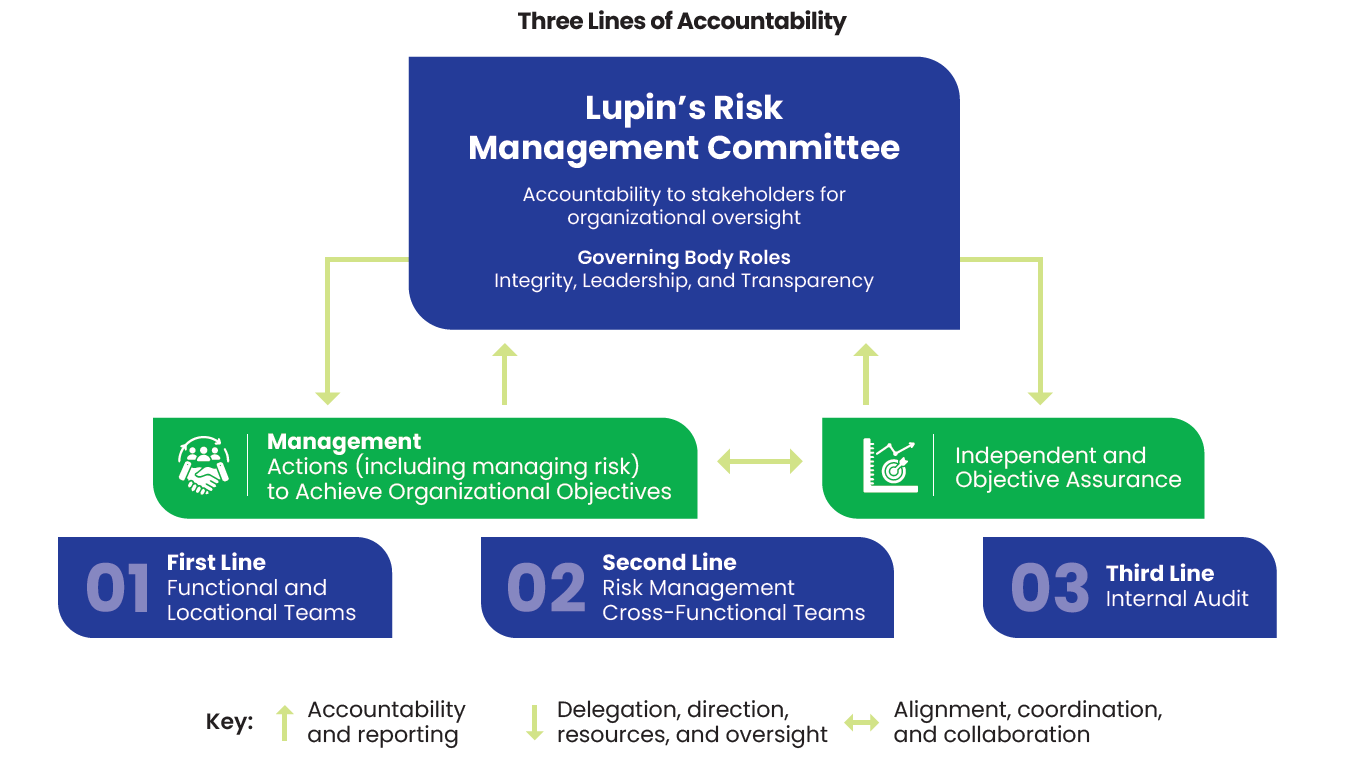

We use the ‘three lines of defense’ framework to ensure comprehensive risk governance. While our Board of Directors provides high-level oversight, the Risk Management Committee (RMC) of the Board is dedicated to overseeing risk management and internal controls. They review and endorse the risk portfolio and set our risk appetite with an awareness of global impacts and interdependencies. The committee meets twice a year to assess management’s actions, ensuring our response is both proactive and informed.

The Risk Management Cross Functional Team is responsible for the overall risk management process at Lupin. This team is composed of risk owners representing key risks, who convene as needed to review risk mitigation measures, monitor changes in risk exposure, and make necessary adjustments to our risk appetite. Detailed reports on risks and mitigation strategies are shared within this team and reported to the RMC. On the ground, our functional and locational teams work in close collaboration with the individual risk owners to periodically review risks and ensure that the risk mitigation plans are effectively executed.

Our independent internal audit unit conducts annual audits to verify that our policies align with the company’s risk strategy. To remain in line with global standards, we invite external experts every two years to review our audit processes. To align our approach with international best practices, we are working towards ISO 31000 Risk Management Certification.

Risk Management Framework

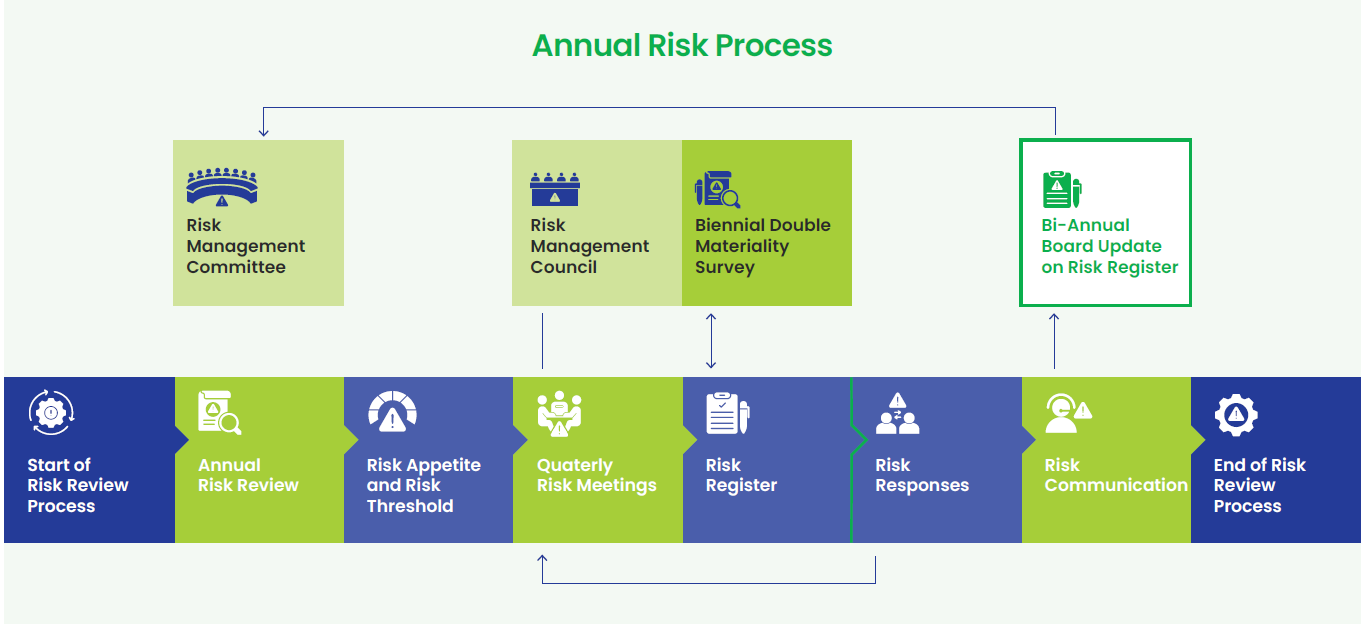

We proactively scan the business landscape to identify emerging risks and opportunities. Our risk owners continuously monitor internal and external environments, while a biennial double materiality exercise assesses risks for financial and impact materiality. Our approach to risk prioritization is informed by insights from risk owners across the organization. Annually, we conduct a comprehensive assessment of risk exposure by evaluating the likelihood of occurrence and the potential impact of identified risks. Our evolving scenario planning and sensitivity analysis exercises strengthen our readiness to address strategic and operational risks, allowing us to anticipate contingencies. Each of the identified risks and opportunities is mapped to risk owners (Senior Leadership – Lupin Presidents), who are supported by site and functional teams, to develop and implement mitigation plans as necessary. Progress is monitored quarterly through risk meetings, with bi-annual updates, including the revised risk register provided to the Board-Level Risk Management Committee. Furthermore, accomplishing risk-related mitigation actions and goals is included in the annual performance evaluation, which directly affects executive and employee compensation and incentives.

Strengthening Our Risk Culture

We provide regular and customized training programs on risk management for the Board of Directors and the Risk Management Committee (including Non-Executive Directors) to enhance their understanding of risk management practices and ensure informed decision-making.

To ensure that employees at all levels are not only aware of potential risks but also equipped with the necessary skills to assess and respond to these risks effectively, we provide multiple risk awareness training programs, skill upgradation sessions, and interactive workshops at our corporate offices and manufacturing sites with risk experts throughout the year. We are dedicated to building a culture where everyone feels empowered to speak up about potential risks. Employees can report concerns directly to their leaders or through the office of the Ombudsperson, which ensures each report is handled with care and professionalism. All employees and contractors are encouraged to identify and report various potential risk expressions, including near-miss incidents, changes in market dynamics, and updates in statutory and regulatory requirements. For instance, recognizing occupational health and safety as a primary concern, we have integrated incentives like the EHSAAS Awards and the Spirit of Lupin Awards to promote vigilance and reporting in this critical area. We also incorporate a thorough risk management process while developing new products or services to ensure both safety and compliance.

Risk Categorization

We categorize our risks into four groups:

Strategic risks that may impede the achievement of an organization’s strategic goals, stemming from key strategic decisions and initiatives.

Operational risks that arise from internal processes, systems, or human errors that can disrupt day-to-day operations.

Emerging risks which are new or rapidly evolving threats characterized by uncertainty, driven by societal changes or trends.

Systemic risks that are long-term industry or environmental trends that have the potential to significantly impact an organization over time.

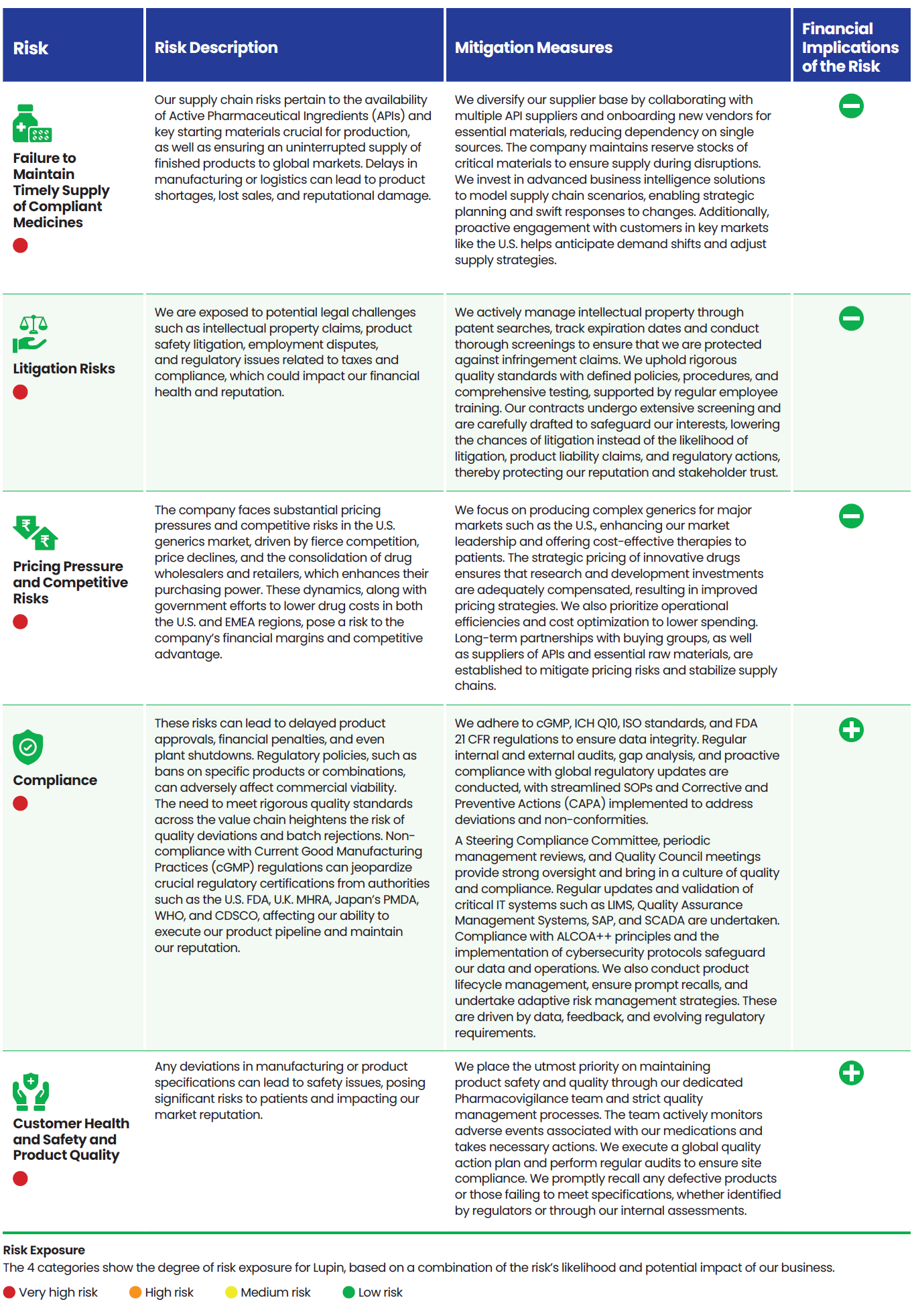

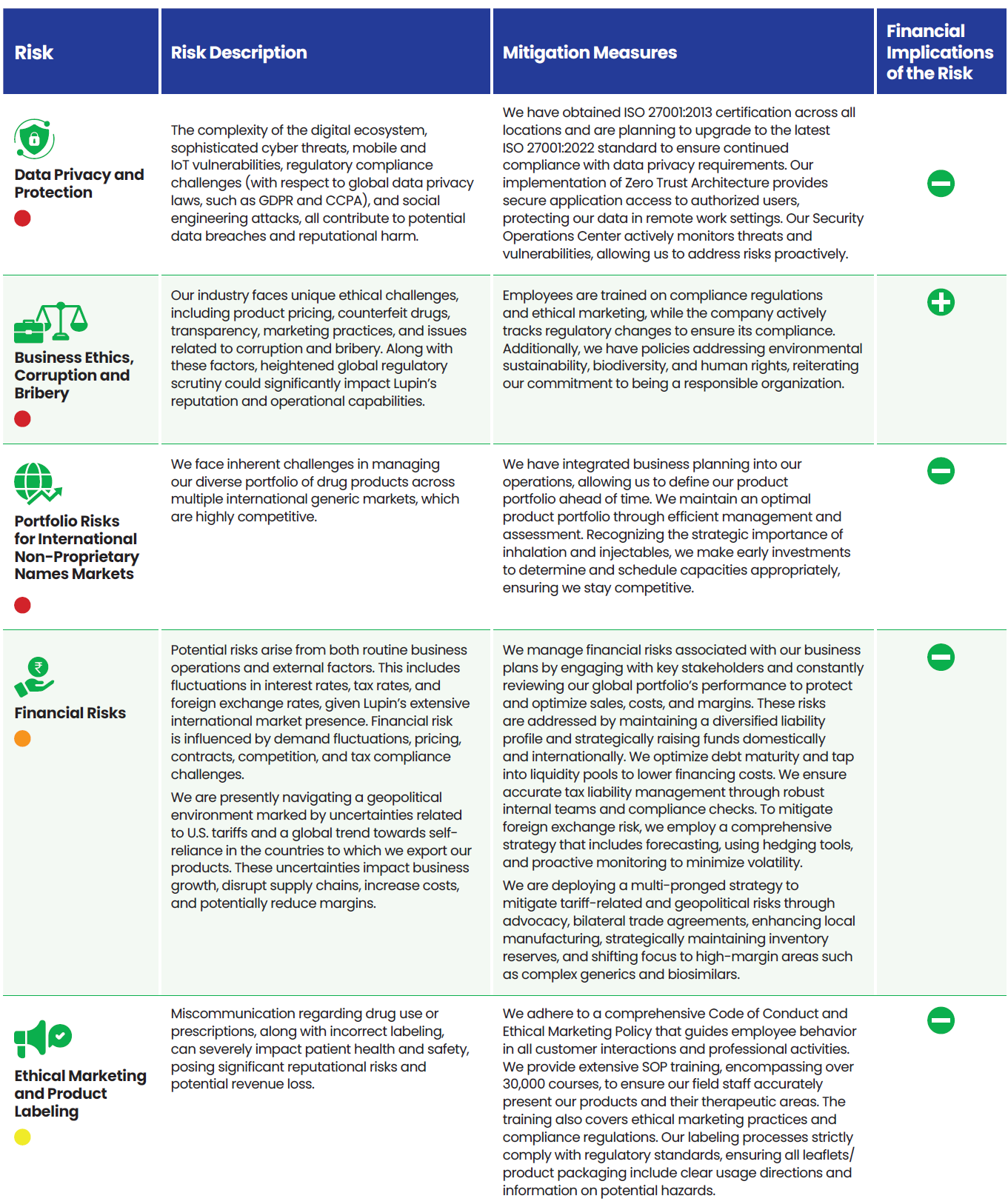

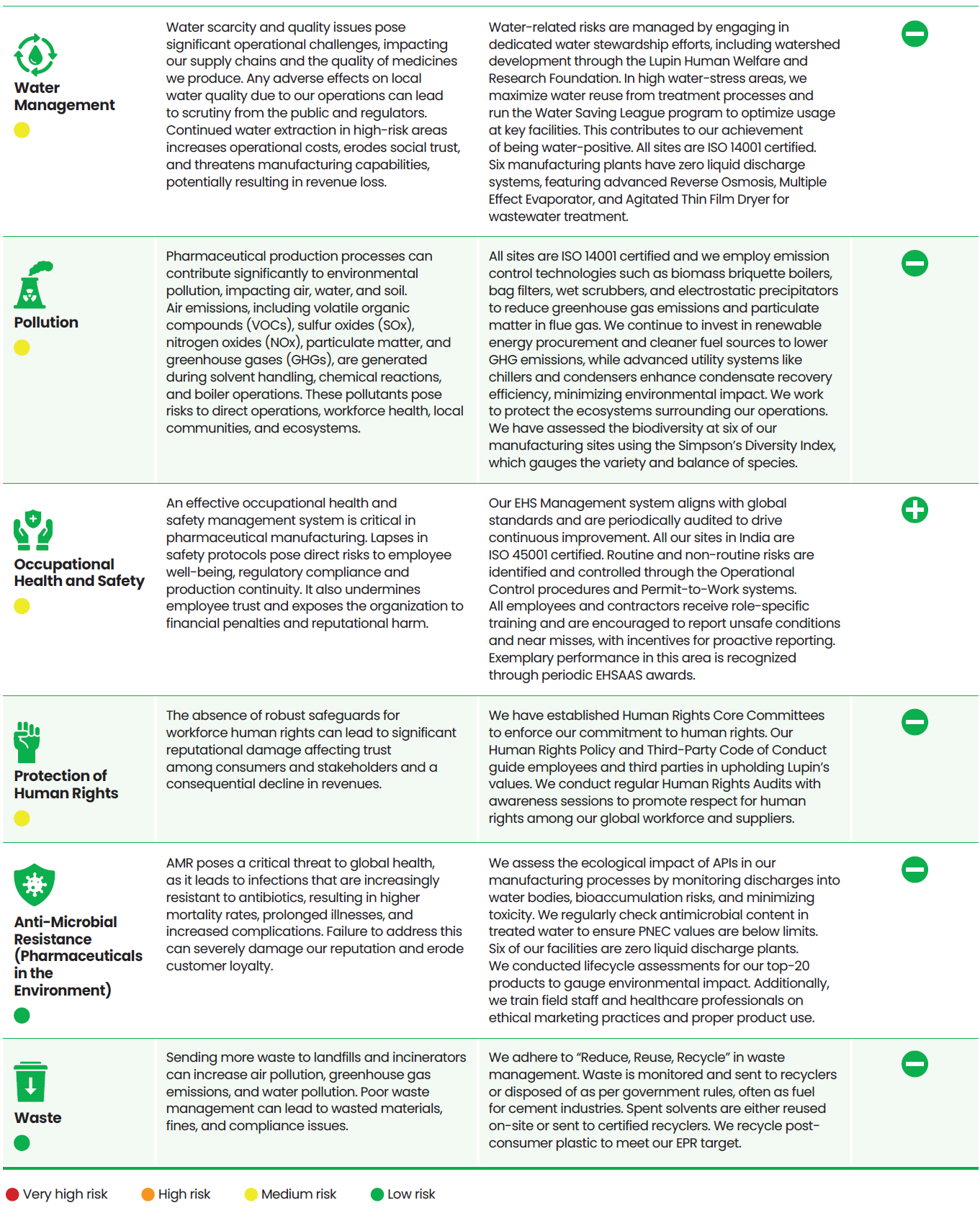

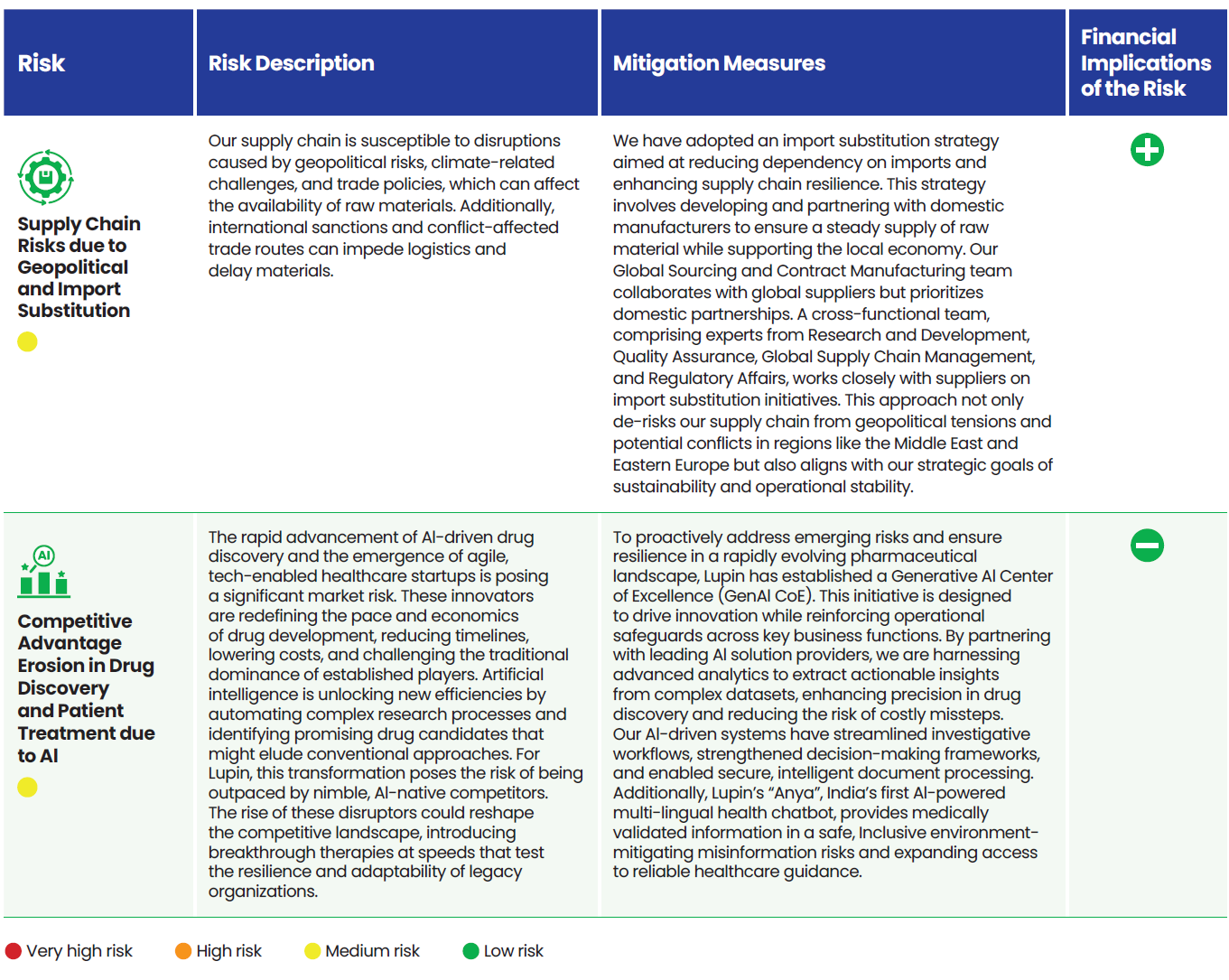

Lupin’s Risk Portfolio 2025

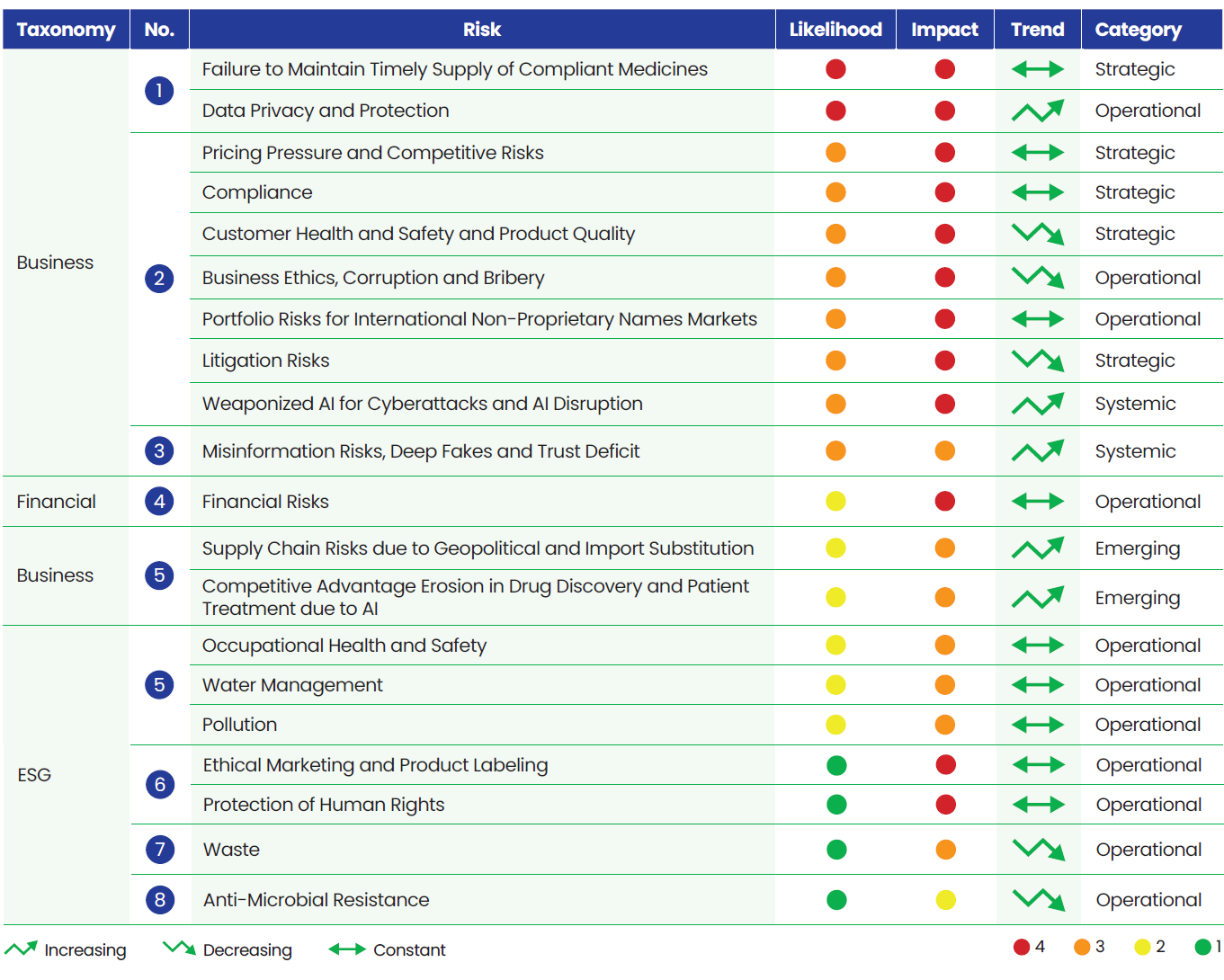

We align the outcomes from the Double Materiality Assessment and Task Force on Climate Related Financial Disclosures (TCFD) study with our ERM process. Our risk portfolio provides a holistic view of risk across the company which is reviewed twice a year.

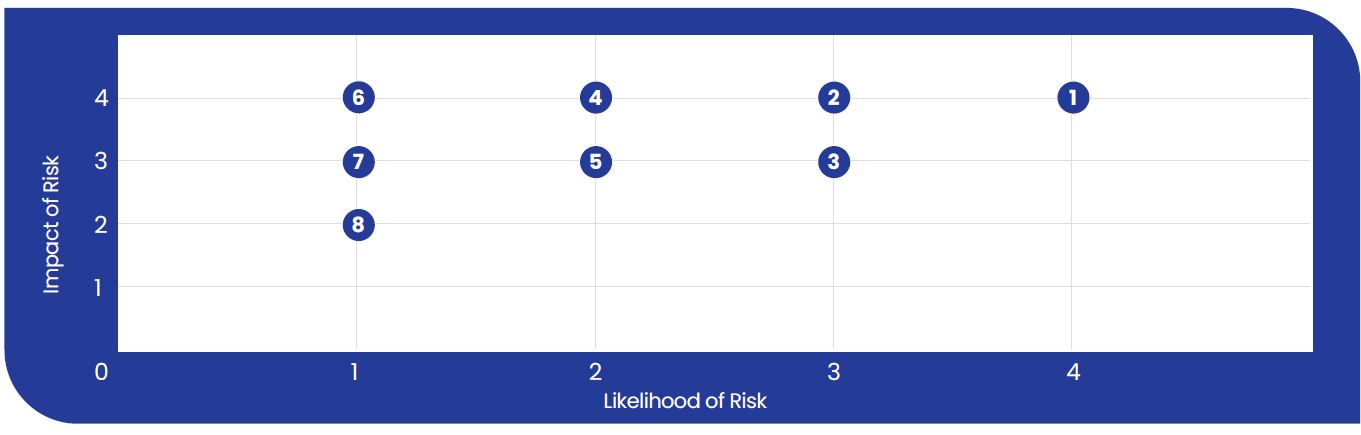

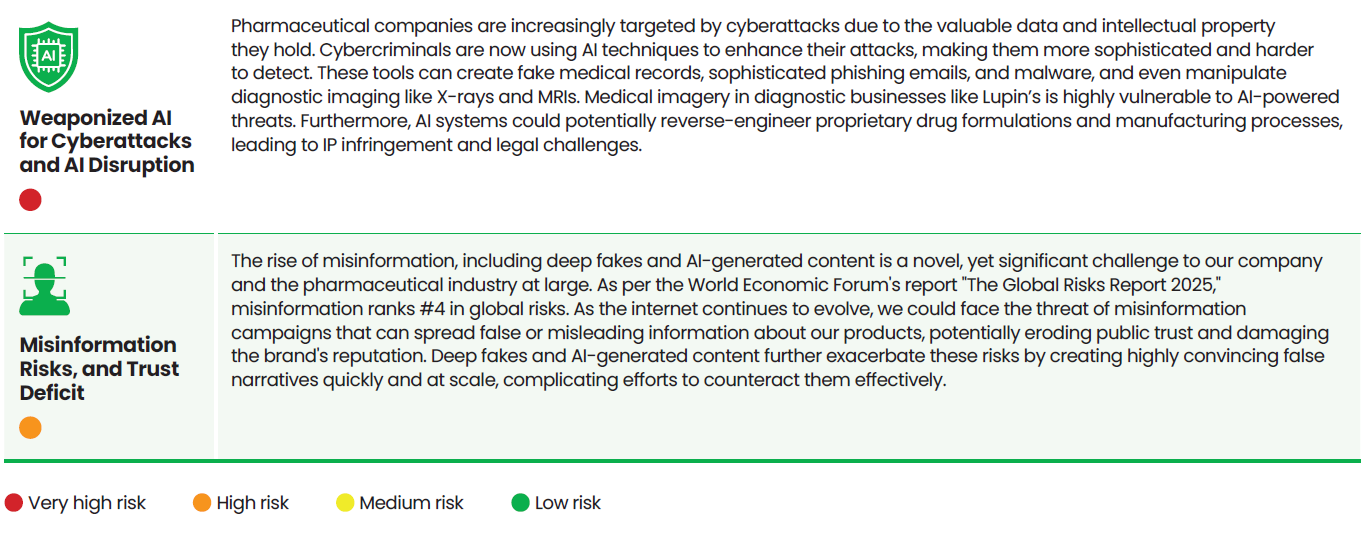

Risks are grouped into four categories (strategic, operational, emerging, and systemic) and assigned a risk exposure rating based on likelihood and potential impact which helps prioritize the key risks.

Risk Prioritization Matrix

Risk Mitigation Measures

| Water Management | We aim to recycle 50% of water consumed and to reduce water withdrawal by 2030. Six of our sites are Zero Liquid Discharge facilities, and we treat all wastewater generated during manufacturing. In high water-stress areas, we are actively reducing water usage through efficient practices and technologies. |

| Green Chemistry | Investing in green chemistry and sustainable manufacturing processes is a strategic initiative that can significantly optimize and enhance the efficiency of our operations. By adopting environment-friendly practices, we reduce our reliance on hazardous chemicals and solvents, replacing them with renewable green alternatives and feedstocks. This not only decreases the carbon and water footprints of our products but also contributes to environmental conservation. |

| Customer Health and Safety | Providing safe and effective drugs enhances brand loyalty and trust between our company and society. Customer safety initiatives further strengthen this trust, lower healthcare costs, and positively impact the company’s financial performance. |

| Human Capital Development | Investing in employee training can significantly drive growth across various facets of the company. By focusing on developing internal resources, we will be able to reduce hiring costs and foster greater internal mobility. This strategy enables us to leverage existing talent, fill positions more efficiently, and maintain a skilled and future-ready workforce. These initiatives will lead to a more resilient and adaptable organization, better positioned to meet market demands and sustain long-term growth. |

| Product Accessibility and Affordability | Expanding access to high disease-burden nations allows us to build trust within society and develop supply chains in untapped markets, enhancing credibility with stakeholders. By focusing on product innovation and research, we increase brand value with affordable and diverse offerings, meeting unmet patient needs and improving access in low-and middle-income countries. |

| Responsible Supply Chain Management | A responsible supply chain reduces costs and strengthens partnerships, enhancing product flow and revenue. By adhering to responsible sourcing, we will be better equipped to handle disruptions and improve our social and environmental performance. |

| Compliance | Implementing industry best practices and compliance governance not only safeguards our company’s credibility but also builds stakeholder trust, presenting opportunities for enhanced customer loyalty and market reputation. |

| Business Ethics | Having strong governance policies in place for ethical business conduct minimizes conflicts of interest, enhancing compliance and enabling us to expand into new markets, thereby strengthening our market position. |

| Combating Counterfeit Medicines | Ensuring drug traceability and authenticity enhances market reputation and boosts our brand’s credibility, while curtailing counterfeit distribution reduces recall costs and strengthens accountability. |

| Risk Management and Business Continuity | By proactively identifying and managing potential risks, we can avoid compliance-related penalties and ensure seamless operations even in the face of disruptions. This is essential for maintaining credibility and trust in our long-term compliance portfolio. |

Assurance Statement

Assurance Statement