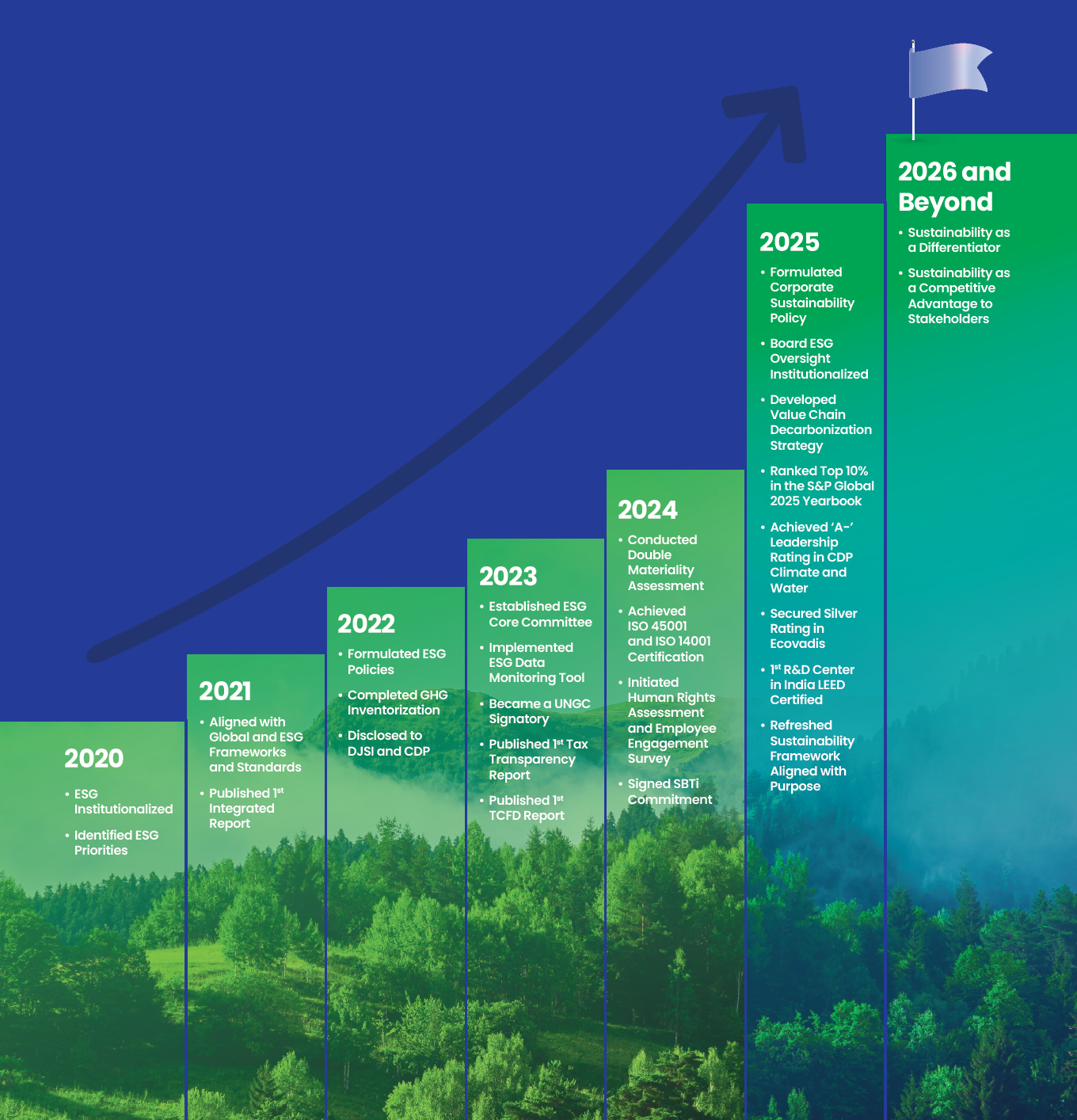

Lupin’s ESG Efforts are Aligned to Global Frameworks, ESG Ratings, and Certifications

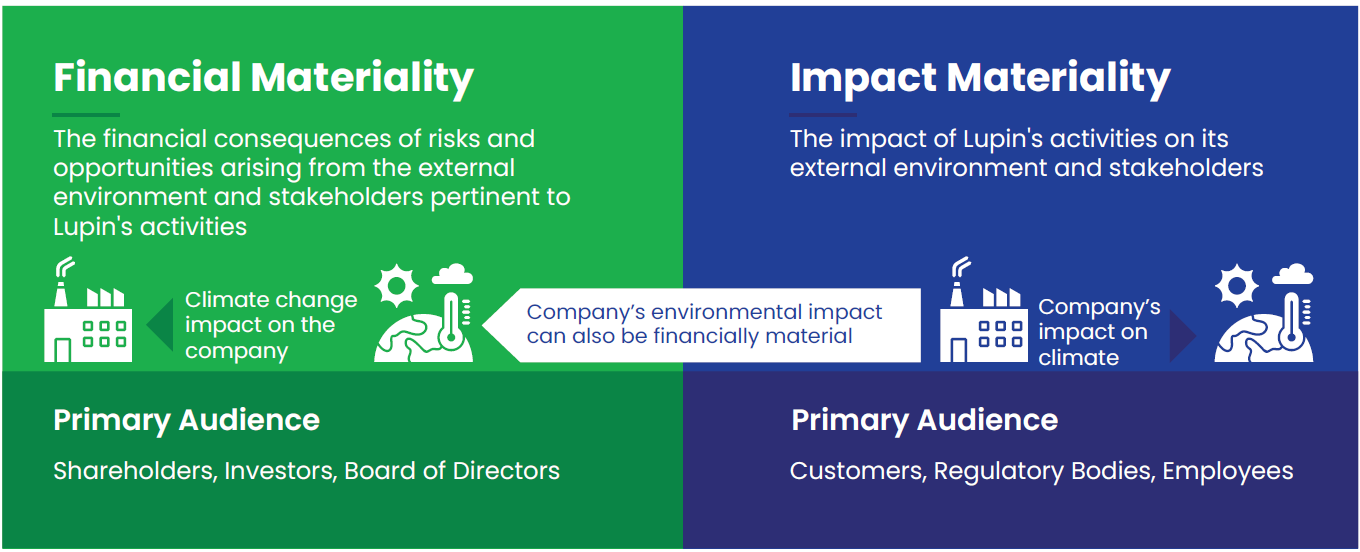

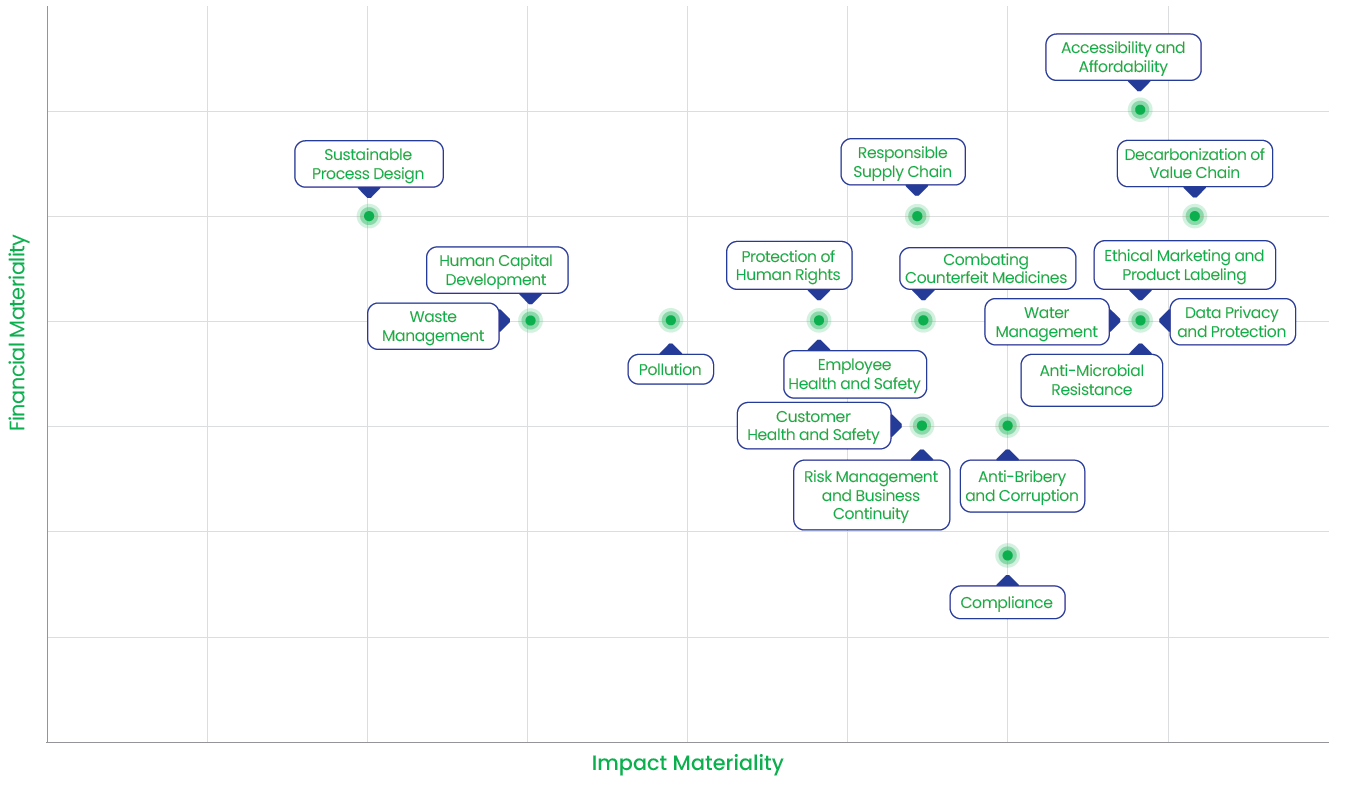

Our double materiality assessment provided valuable insights into the pharmaceutical industry and Lupin’s efforts in addressing environmental, societal, and organizational issues. Guided by the Corporate Social Responsibility Directive (CSRD) framework, the double materiality approach enabled us to peer into our stakeholder perspectives of how the environment and society impact our business and the effects of our business on the environment and society. This exercise is conducted biennially to ensure that our topics remain current with industry trends. Through this assessment process, we identified 18 priority areas that we consider materially significant for Lupin.

By applying a double materiality perspective, we evaluated the financial implications and the significant impact of each topic, along with our ability to remediate negative effects. This was preceded by extensive stakeholder consultations through surveys and in-person consultations. This year, we conducted a review of our material topics with business vertical leaders and carried out a validation exercise to ensure our operations align with the identified topics. The materiality outcomes were reviewed and signed off by the SCSR (Sustainability and Corporate Social Responsibility) board committee. The assessment outcomes led to the strengthening of our approach to stakeholder engagement, risk management strategies, and operational approach to align ourselves with stakeholder expectations.

Approach to Materiality Assessment

|

|

|

|

|

|

|---|---|---|---|---|

|

Landscape Analysis |

Stakeholder Engagement |

Prioritization of Material Topics |

Applying Double Materiality Principles |

Finalization of Topics |

|

We conducted a detailed desk assessment, analyzing the macro trends of the pharmaceutical industry, business environment, and potential risks and opportunities, that may arise. This helped us create a comprehensive list of 50 topics. |

Conducted stakeholder consultations with internal and external stakeholders via surveys and in-person discussions. Our survey consisted of 30 material topics and we engaged with over 550 external and 200 internal stakeholders |

We recevied responses from 350 stakeholders, representing 46% of our total engagement pool. Based on the responses, we ranked the topics according to stakeholder prioritization. |

We identified 18 highpriority topics and evaluated them through the lens of financial and impact materiality. This analysis enabled us to understand the potential impact associated with each topic, as well as our capacity to mitigate any negative consequences. Additionally, we assessed the related financial risks and opportunities. |

Based on the results of the impact and financial materiality assessment, we prioritized the topics by mapping them onto a materiality matrix. |

The below identified material topics have guided our Enterprise Risk Management Framework, enabling us to manage risks and opportunities effectively and allocate resources efficiently. Through this process, we have identified key risks and opportunities and developed strategies to mitigate risks and capitalize on opportunities.

Our Materiality Matrix

Material Issues for External Stakeholders

| Material Topic | Accessibility and Affordability | Waste Management | Decarbonization of Value Chain |

|---|---|---|---|

| Cause of Impact |

Business Activity Coverage |

Business Activity Coverage |

Business Activity Coverage |

| Relevance to External Stakeholders | The gap between affordable healthcare and equitable access continues to grow. According to the WHO, more than half of the global population lacks access to essential health services, and approximately 800 Mn people spend at least 10% of their household budgets on healthcare expenses. This is widening the gap between access and affordability in low-and middle-income countries, which consequently are also the ones with the highest disease burden. | Pharmaceutical waste is becoming a growing concern in markets as healthcare needs rise and the improper disposal of unused medicines and packaging material, continues to become a growing problem throughout the world. Excessive landfilling and other unsafe disposal methods pose health concerns for communities, especially those that live near disposal or incineration centers. This is raising alarms as consumers scrutinize drug manufacturers on their disposal practices. | With the impact of global warming escalating at a rapid pace, the importance of a global push for decarbonization has become more pertinent than ever. Decarbonization has become a business priority for external stakeholders as well due to the negative externalities, the brunt of which is borne by consumers and communities outside of business operations. Companies are more cognizant than ever of the negative impact their carbon footprint has on ecosystems and communities as a whole, and pressures to align with the 1.5-degree Celsius agenda has become a key factor for stakeholders when choosing their products. |

| Type of Impact | Positive and negative | Positive and negative | Positive and negative |

| Impact Valuation | Improvement in community health and well-being | Reduction of total waste to landfill | Reduction of GHG emissions |

| Impact Metric | Reduction of disease burden in low-and-middle income regions | Reduction of waste and improper disposal of waste at landfills | Social cost of carbon |

| Output Metric | Easy access to low-cost medication | Reduction in waste to landfill | Avoided CO2 emissions |

Material Issues for Enterprise Value Creation

| Material Topic | Accessibility and Affordability | Water Management | Responsible Supply Chain |

|---|---|---|---|

| Business Case | With our portfolio of generics, and extensive global presence, we are well-equipped to provide patients globally with access to essential medicines and to meet the increasing demand for pharmaceutical products. Barriers to access, such as pricing and availability, negatively impact the ability to obtain necessary medications and may pose challenges to our vision and long-term growth potential. | Effective water and waste management is crucial for the company to create a positive environmental impact. Prioritizing efficient water usage, minimizing waste generation, and ensuring proper disposal are essential to showcase our commitment to a sustainable future and a healthier planet. | The pharmaceutical industry’s dependence on the supply chain for critical raw materials and the final delivery of medicines could mean that any disruption can affect business continuity and product quality. Reliance on non-substitutable suppliers poses a risk to the consistent availability of essential raw materials. |

| Business Impact | The company’s innovation and research efforts boost brand value by positioning the company as a source of diverse, accessible, and affordable treatments. This excellence and recognition, paired with our access initiatives that address unmet patient needs and improve access in low- and middle-income countries, also bring new revenue streams. | Persistent high water consumption in areas experiencing water stress increases the risk of rising operational costs, which can disrupt manufacturing capabilities and result in overall revenue loss. Inadequate management of environmental impact can result in legal, regulatory, and financial consequences, damage to reputation and stakeholder trust, and ultimately, a loss of license to operate. |

Supplier relationships come under scrutiny when the company starts disqualifying supplier contracts based on their compliance to required regulatory and ESG standards, resulting in a loss of business value. Dependence on non-substitutable and critical raw material suppliers poses a risk to the business in the event of unforeseen disruptions. |

| Business Strategies | We are dedicated to building a resilient and varied product portfolio by strengthening cross-functional synergies, organizational capabilities, project management, and governance. Our focus is on identifying, developing, planning, and launching new products. We prioritize developing and commercializing advanced generics, supported by operational excellence initiatives aimed at improving yields, ensuring supply chain continuity, and maintaining sufficient inventories. | We monitor our water consumption on a regular basis. Our efforts are concentrated on optimizing water usage, minimizing withdrawals, and enhancing water recovery. We aim to strengthen the Zero Liquid Discharge at our facilities to treat manufacturing wastewater responsibly. Additionally, we are committed to protect water use in regions facing water scarcity, reducing our environmental impact. | We have initiated a comprehensive exercise to assess 100% of our critical suppliers through our ESG framework. We also screen our new suppliers during the onboarding process by asking them to conduct a self-assessment on ESG and other financial and non-financial metrics. Our suppliers are also required to consent to and uphold the company’s ESG standards as outlined in our Supplier Code of Conduct. |

| Linked Target/Goal | Lyfe provides post-acute coronary syndrome (ACS) and heart failure patient care, aiming to reach 25,000 patients. | Recycling of 50% of our total water withdrawal in our India operations. | 100% coverage of critical suppliers (RM and PM) through ESG framework within a three-year cycle. |

| Target Year | 2030 | 2030 | 2028 |

| Progress | 3,749 Patients | 44% | 100% |

Executive Compensation Linkage

To demonstrate our commitment to ESG goals and material KPIs, the Chief Executive Officer, Managing Director, Global Chief Financial Officer, Presidents, Business Unit Managers, and relevant employees include ESG objectives as part of their variable compensation assessments. Lupin has integrated ESG goals into its corporate objectives, meaning the achievement of these goals directly influences executive and employee compensation and annual bonus/variable compensation.

Our ESG targets for FY25 focussed on areas such as climate change, GHG emissions reduction, water recycling, waste management, biodiversity, Diversity, Equity, and Inclusion (DEI), patient-centric innovation, and access and affordability. These targets are assigned to relevant Presidents responsible for these goals and are cascaded down to business functions with appropriate weight during the Annual Performance and Year-End Rewards process.

Guided by our purpose of catalyzing treatments that transform hope into healing, our sustainability strategy aims to address environmental and social challenges impacting Planet, People, and Patients. Our goals are based on specific targets and timelines, with clearly defined goal owners, and are monitored regularly.

Our Purpose

We catalyze treatments that transform hope into healing

Our ESG Framework

Paving a sustainable future for Planet, People, and Patients

Planet

Planet

Catalyzing Planet Action

Climate Change

Water

Waste

Biodiversity

People

People

Transforming Our People

Diversity and Inclusion

Employee Volunteering

Employee Well-Being and Safety

Supplier Sustainability

Patients

Patients

Healing Patients

Product Launches and Quality

Patient Assistance Program

Education and Awareness

Diagnosis and Rehabilitation

Planet

Planet

| Goal Owner: Chief Technical Operations Officer | |||

|---|---|---|---|

| 1. Scope 1 and 2 Emissions | 38% Absolute reduction from FY23 | 2030 | 26% |

| 2. Scope 3 Emissions | 61% Intensity reduction from FY24 | 2034 | New goal |

| 3. Renewable Electricity | Achieve 35% renewable electricity share | 2030 | 18% New goal |

| 4. Water Recycling | Recycling of 50% of our total water withdrawal in our India operations | 2030 | 44% |

| 5. Water Reduction | 10% Reduction in absolute water withdrawal from FY21 | 2030 | 7% New goal |

| 6. Water Positivity | Sustain water positivity | Year Over Year | Water positive |

| 7. Zero Waste to Landfill | 50% of our manufacturing sites in India | 2030 | New goal |

| 8. Circular Economy | 90% of incinerable hazardous waste generated in our Indian operations goes for preprocessing/coprocessing | Year Over Year | 92% |

| 9. Life Cycle Assessment (LCA) | Completion of LCA for 30% of products (total products: 80) | 2030 | 30 Products |

| 10. Biodiversity Assessment | 100% of global sites to be covered by biodiversity assessment | 2030 | 40% |

| 11. Anti-Microbial Resistance (AMR) Risk Assessment | To complete the AMR risk assessment for three products | Year Over Year | 2 products New goal |

People

People

| Goal Owner: President — Global Human Resources | |||

|---|---|---|---|

| 1. Diversity, Equity, and Inclusion (DEI) | 15% Women at workplace in India operations | 2030 | 9% |

| 10% Women in junior management | 2030 | 6% | |

| 15% Women in top management | 2030 | 12% | |

| Accessibility audit for PWD for all India locations | 2030 | Will be initiated in FY27 | |

| 2. Community Engagement | Employee volunteering program: 50,000 hours | 2030 | 24,369 |

| 3. Employee Well-Being | Achieve and maintain an employee satisfaction score of 80% in annual surveys | Year Over Year | 80% |

| 4. Human Rights | Human rights assessment of our sites | Year Over Year | 17 Sites certified |

| Goal Owner: Chief Technical Operations Officer | |||

| 5. ESG Assessment of Suppliers | 100% Coverage of critical suppliers (RM and PM) through ESG framework within a three-year cycle | Every Three Years | Ongoing |

| 6. ESG Screening | ESG screening of new suppliers to be incorporated | 2025 | Completed |

| 7. Personnel Safety | Zero fatality | Year Over Year | 1 |

| With baseline of FY20: | |||

| >5% Reduction in LTIFR | Year Over Year | >33.7% Reduction in LTIFR | |

| >5% Reduction in accident frequency rate | Year Over Year | >14% Reduction in number of accidents | |

| >5% Reduction in incidents frequency rate including fires and spills | Year Over Year | >30% Reduction in number of incidents, including fires and spills | |

| >5% Increase in Near Miss Ratio (NMR) | Year Over Year | >12% Increase in NMR | |

| >5% Increase in training index | Year Over Year | >14% Increase in training index | |

| Goal Owner: Head — Corporate Social Responsibility | |||

| 8. Social Impact (CSR) | Livelihood: Impacting 2.5 Mn beneficiaries Lives: Impacting 500,000 individuals |

2030 | Livelihood: 248,256 Lives: 165,888 |

Patients

Patients

| Goal Owner: President — India Region Formulations | |||

|---|---|---|---|

| 1. Patient Assistance Programs | Benefitting 300,000 patients | 2030 | JAI: 31,300 HuMrahi: 72,277 Total: 103,577 |

| 2. Education and Awareness Programs | 3 Mn patients | 2030 | 1,491,740 |

| 50,000 Health Care Professionals (HCP)/Doctors | 2030 | 38,974 | |

| 3. Diagnosis | Assist in the diagnosis of lung disease for more than 2 Mn patients | 2030 | Spirometry: 871,098 FENO: 40,510 FOT: 78,691 Total: 990,299 |

| Target the diagnosis of breast cancer in 5000 women | 2030 | 2,432 | |

| 4. Rehabilitation | Neuro Rehabilitation Centre targeting an outreach of 100,000 sessions | 2030 | 39,811 |

| 5. Full Care | Lyfe provides post-acute coronary syndrome and heart failure patient care, aiming to reach 100,000 patients | 2030 | 3,749 |

| 6. Local Manufacturing Partnership | Developing partnership with an African firm to improve accessibility | 2027 | In-principle agreement signed with a South African company for local manufacturing |

| Goal Owner: President — Chief Scientific Officer | |||

| Complex Generics in Regulated Markets | |||

| 7. Complex Inhalation Products | 10 Launches | 2028 | 3 |

| 8. Complex Injectables | 5 Launches | 2028 | 2 |

| 9. Ophthalmology, Dermatology and Women's Health | 5 Launches | 2028 | 2 |

| 10. Biosimilars | 3 Filings in regulated markets | 2028 | 1 Filing of Ranibizumab completed 4 more filings as per plan, covering markets in U.S., Europe, Canada, and Japan |

| Goal Owner: Chief Quality Officer | |||

| 11. Data Integrity | Ensure zero observations in any regulatory audits | Year Over Year | 0 |

| 12. Class 1 Recalls | Zero | Year Over Year | 0 |

| 13. Warning Letter/Official Action Indicated (OAI) Status | Zero | Year Over Year | 0 |

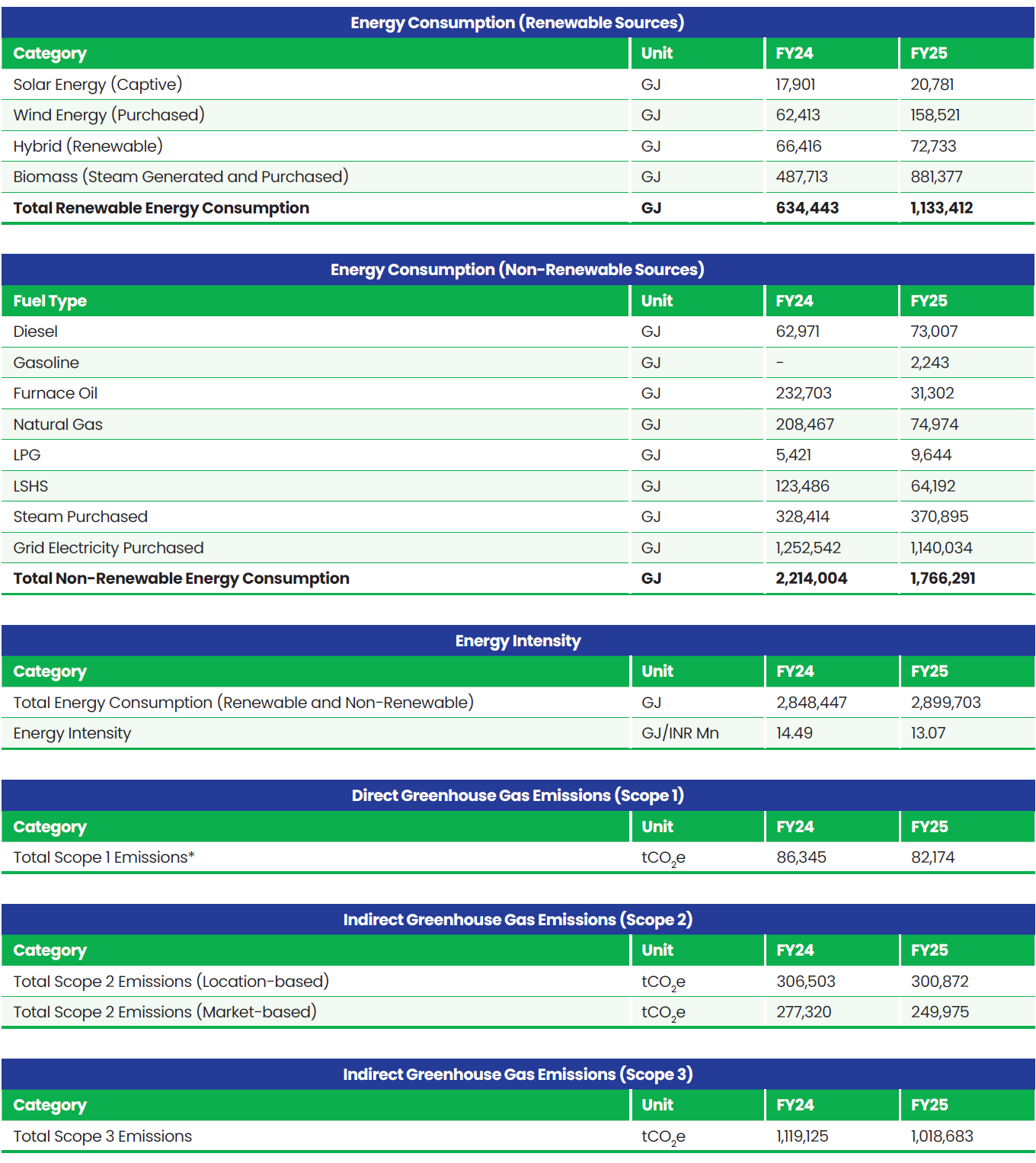

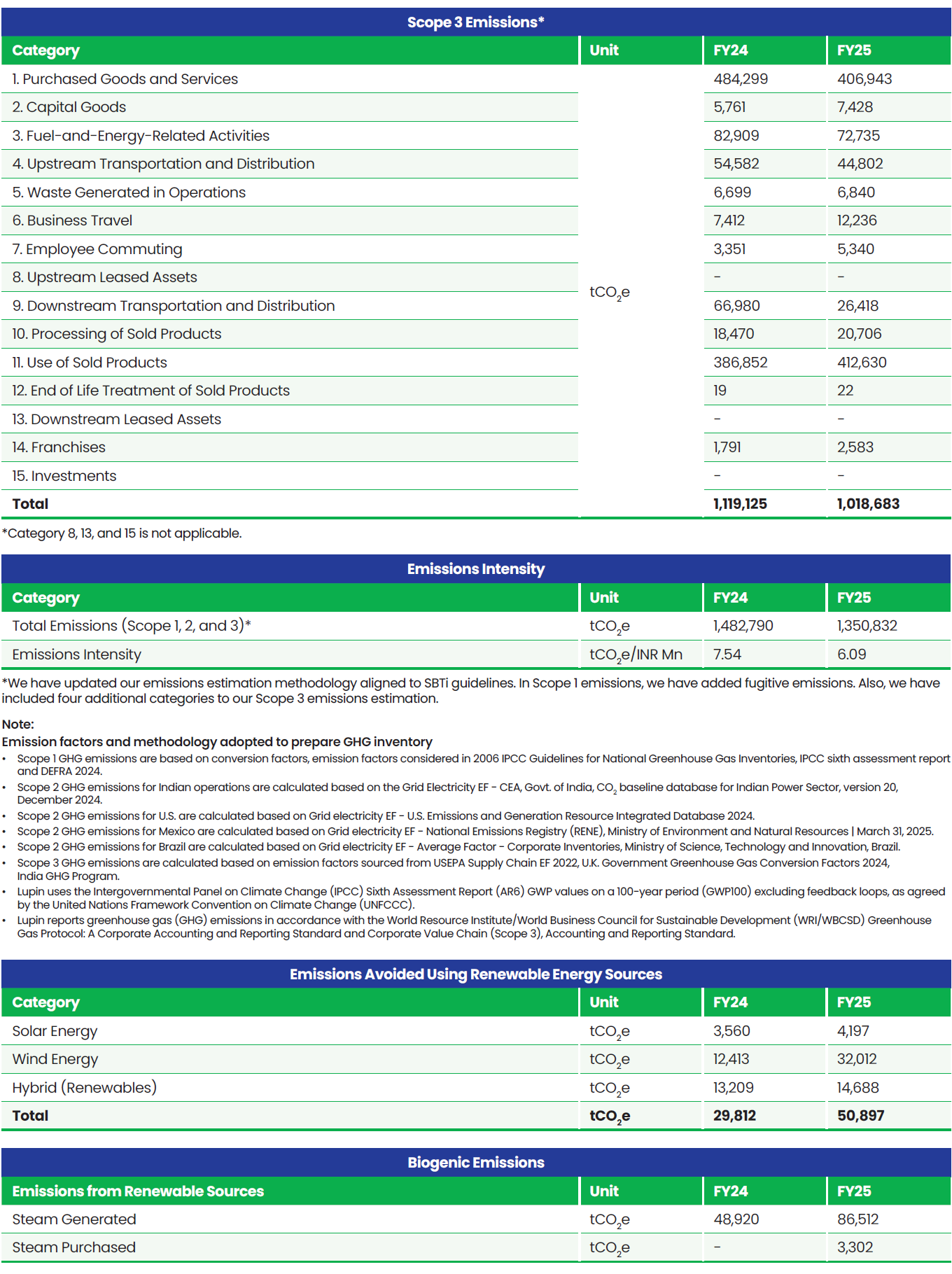

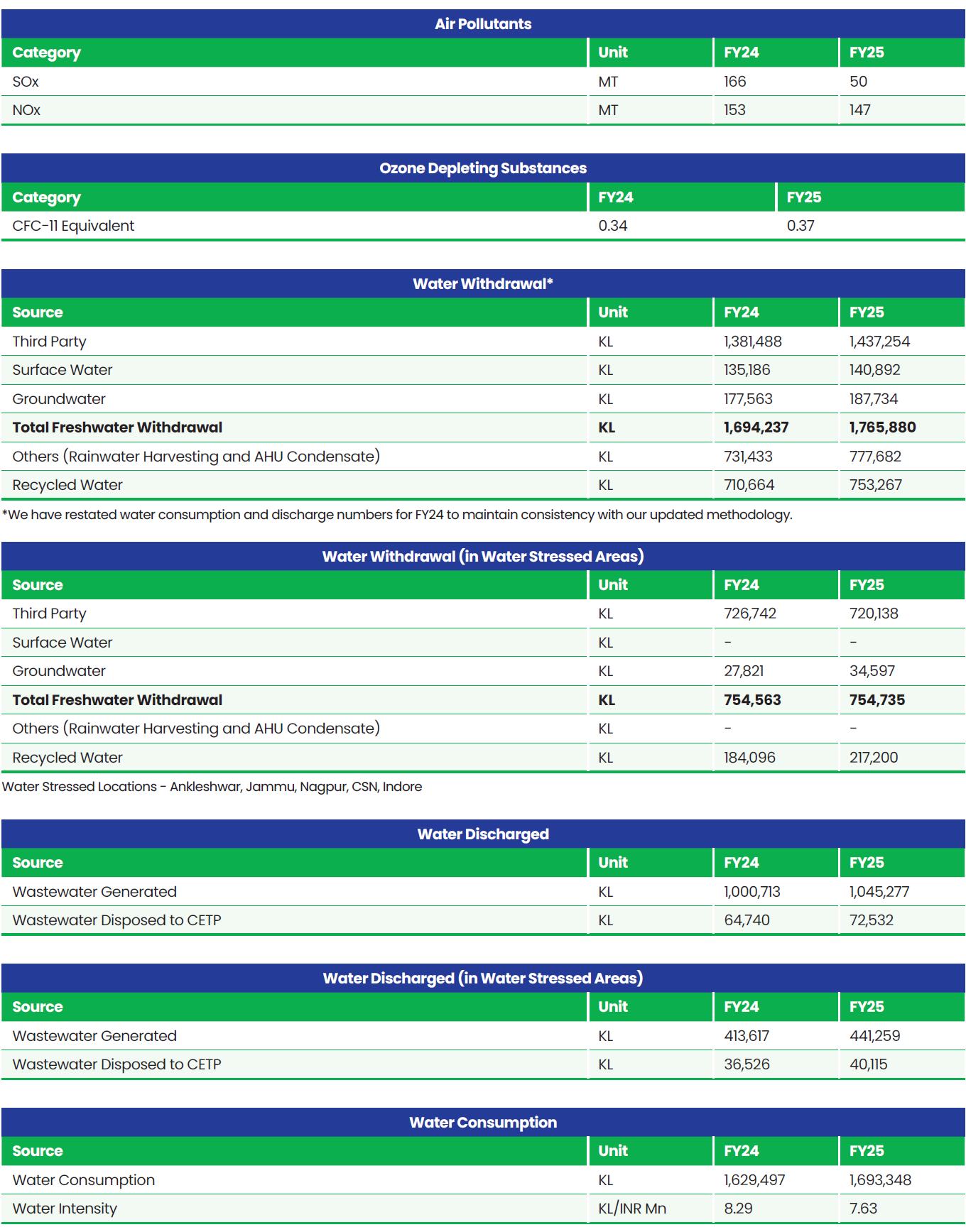

Boundary for Environment Data: Global

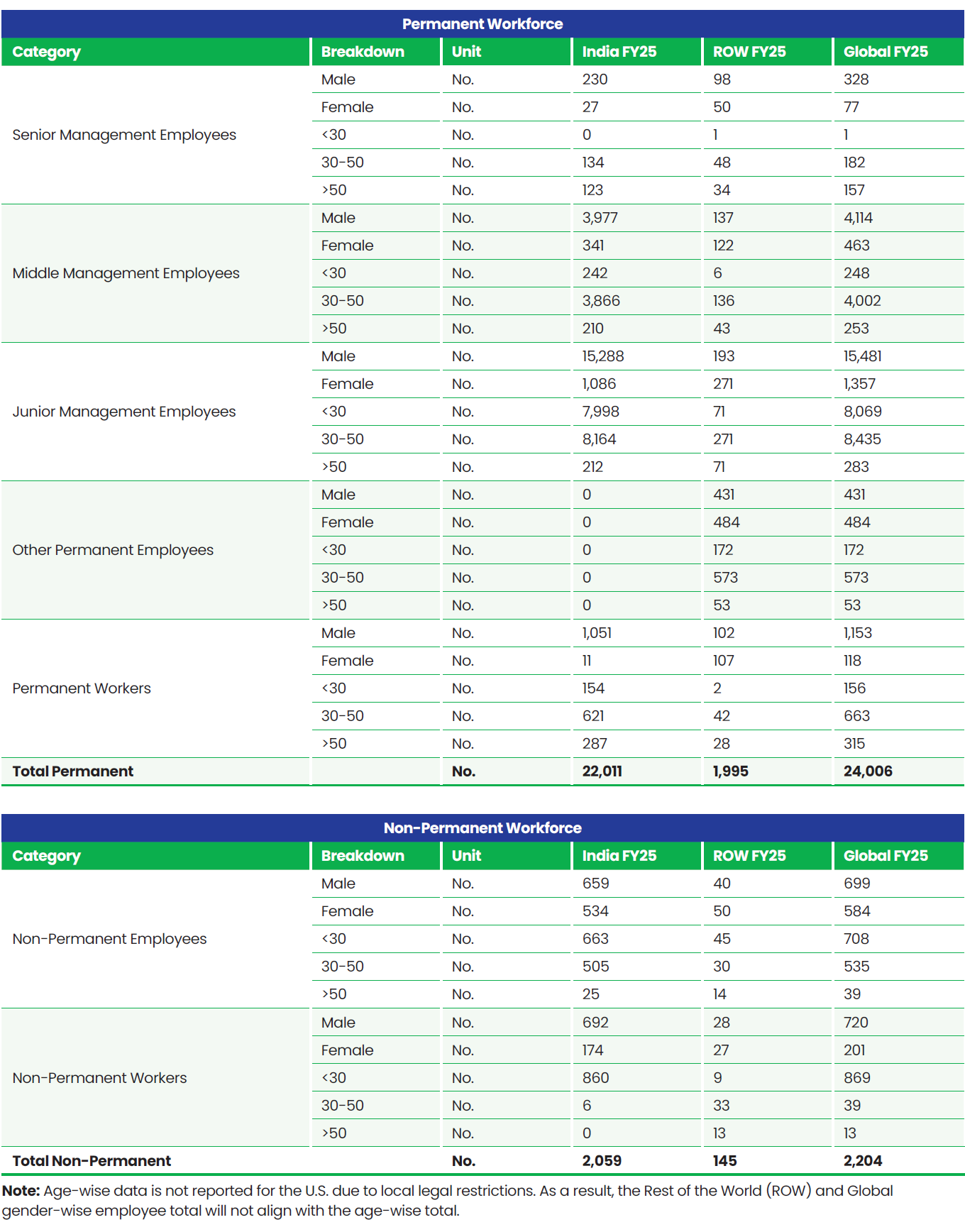

Total Workforce

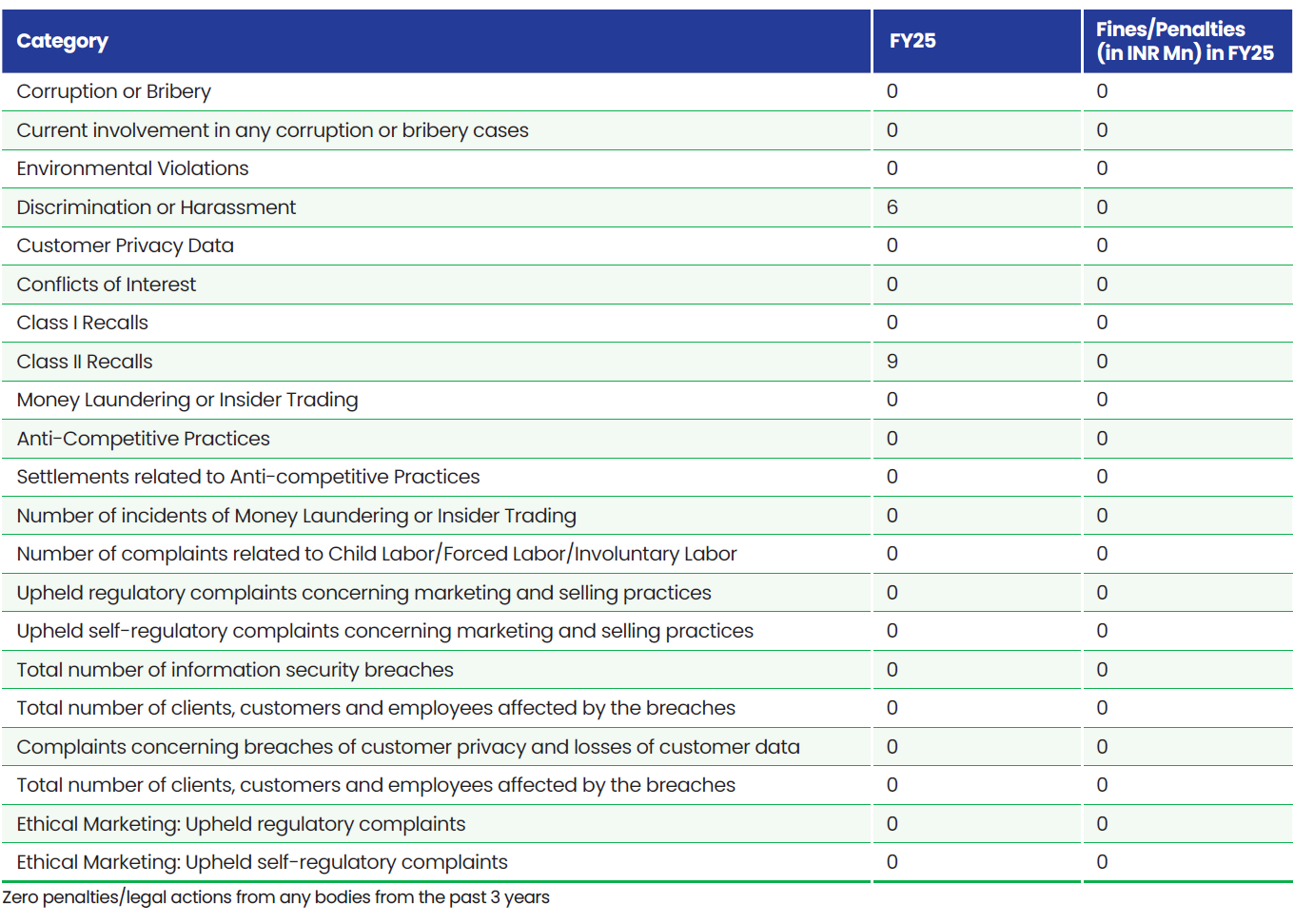

Fines/Settlements/Complaints