| Particulars | Q2 FY2026 | Q2 FY2025 | Growth YOY | Q1 FY2026 | Growth QOQ |

| U.S. | 27,624 | 18,753 | 47.3% | 24,041 | 14.9% |

| India | 20,777 | 20,096 | 3.4% | 20,894 | -0.6% |

| Other Developed Markets | 8,117 | 6,824 | 18.9% | 7,748 | 4.8% |

| Emerging Markets | 9,228 | 6,353 | 45.3% | 6,524 | 41.4% |

| Total Formulations | 65,746 | 52,026 | 26.4% | 59,207 | 11.0% |

| API | 2,568 | 2,944 | -12.8% | 2,431 | 5.6% |

| Total Product Sales | 68,314 | 54,970 | 24.3% | 61,638 | 10.8% |

| Note: Q2 FY2025 have been regrouped for comparison |

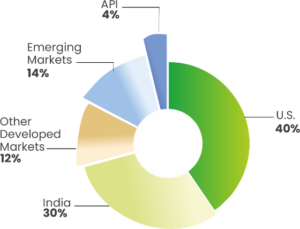

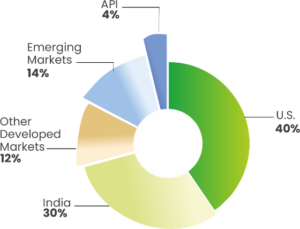

Q2 FY2026 – Sales Mix

Operational Highlights

U.S.

U.S. sales for Q2 FY2026 were INR 27,624 Mn up 47.3% compared to INR 18,753 Mn in Q2 FY2025; (USD 315 Mn in Q2 FY2026 compared with USD 223 Mn in Q2 FY2025); accounting for 40% of Lupin’s global sales.

The Company received 6 ANDA approvals from the U.S. FDA, and launched 6 products in the quarter in the U.S. The Company now has 147 generic products in the U.S Market.

Lupin continues to be the 3rd largest pharmaceutical player in both U.S. generic market and U.S. total market by prescriptions (IQVIA Qtr. TRx Sep 2025). Lupin is the leader in 49 of its marketed generics in the U.S. and amongst the Top 3 in 113 of its marketed products (IQVIA Qtr Sep 2025 by extended units).

India

India sales for Q2 FY2026 were INR 20,777 Mn, up 3.4% compared to INR 20,096 Mn in Q2 FY2025; accounting for 30% of Lupin’s global sales. India Region Formulation sales up by 8.8% in the quarter as compared to Q2 FY2025.

The Company launched 6 brands across therapies during the quarter. Lupin is the 8th largest company in the Indian Pharmaceutical Market (IQVIA MAT Sep 2025).

Other Developed Markets

Other Developed markets sales for Q2 FY2026 were INR 8,117 Mn, up 18.9% compared to INR 6,824 Mn in Q2 FY2025; accounting for 12% of Lupin’s global sales.

Emerging Markets

Emerging Markets sales for Q2 FY2026 were INR 9,228 Mn, up 45.3% compared to INR 6,353 Mn in Q2 FY2025; accounting for 14% of Lupin’s global sales.

Global API

Global API sales for Q2 FY2026 were INR 2,568 Mn, down 12.8% compared to INR 2,944 Mn in Q2 FY2025; accounting for 4% of Lupin’s global sales.

Research and Development

Investment in R&D was INR 5,091 Mn (7.5% of sales) for the quarter as compared to INR 4,481 Mn (8.2% of sales) for Q2 FY2025.

Lupin received approval for 6 ANDAs from the U.S. FDA in the quarter. Cumulative ANDA filings with the U.S. FDA stand at 433 as of September 30, 2025, with the company having received 341 approvals to date.

The Company now has 50 First-to-File (FTF) filings including 20 exclusive FTF opportunities. Cumulative U.S. DMF filings stand at 91 as of September 30, 2025.

About Lupin

Lupin Limited is a global pharmaceutical leader headquartered in Mumbai, India, with products distributed in over 100 markets. Lupin specializes in pharmaceutical products, including branded and generic formulations, complex generics, biotechnology products, and active pharmaceutical ingredients. Trusted by healthcare professionals and consumers globally, the company enjoys a strong position in India and the U.S. across multiple therapy areas, including respiratory, cardiovascular, anti-diabetic, anti-infective, gastrointestinal, central nervous system, and women’s health. Lupin has 15 state-of-the-art manufacturing sites and 7 research centers globally, along with a dedicated workforce of over 24,000 professionals. Lupin is committed to improving patient health outcomes through its subsidiaries – Lupin Diagnostics, Lupin Digital Health, and Lupin Manufacturing Solutions.

To know more, visit www.lupin.com or follow us on LinkedIn https://www.linkedin.com/company/lupin

For further information or queries please contact –

Rajalakshmi Azariah

Vice President & Global Head – Corporate Communications, Lupin

rajalakshmiazariah@lupin.com