Mumbai: Pharma Major Lupin Limited reported its financial performance for the second quarter ending September 30th, 2017. These results were taken on record by the Board of Directors at a meeting held in Mumbai today.

Key Financial & Performance Highlights

- Sales for the quarter grew by 1.8% to Rs. 38,742 m. compared to Rs. 38,068 m. in Q1 FY2018

- Sales for quarter decreased by 8.0% compared to Rs. 42,112 m. in Q2 FY2017

- H1 FY2018: Sales were Rs. 76,810 m. compared to Rs. 85,530 m. in H1 FY2017

- Earnings before Interest, Tax, Depreciation and Amortization (EBITDA) for the quarter grew by 15.8% to Rs. 9,271 m. (23.9% of sales) compared to Rs. 8,003 m. in Q1 FY2018

- EBITDA for the quarter decreased by 12.3% compared to 10,576 m. in Q2 FY2017

- H1 FY 2018: EBITDA was 17,274 m. compared to Rs. 24,510 m. in H1 FY2017

- Net profits for the quarter grew by 27.1 % to Rs. 4,550 m. compared to Rs. 3,581 m. in Q1 FY2018

- Net profits for the quarter decreased by 31.3% compared to Rs. 6,622 m. in Q2 FY2017

- H1 FY2018: Net profits were Rs. 8,131 m. compared to Rs. 15,441 m. in H1 FY2017

- Investment in Research for the quarter was Rs. 4,739 m., 12.2% of sales

Commenting on the results, Mr. Nilesh Gupta, Managing Director, Lupin Limited, said “In Q2 we have recorded strong growth in all our markets but for the US generic business where we continue to see pricing pressure, as expected. The EBIDTA growth was further fueled by our optimization efforts around operations and R&D investment. We are on track with our complex generic pipeline and have made significant progress on the speciality front with the acquisition of Symbiomix in the US.”

Consolidated unaudited financial Results – Quarter II, FY2018

Amount in Rs. m.

| Particulars | Q2 FY2018 | % of sales | Q1 FY2018 | % of sales | QoQ Growth % | Q2 FY2017 | % of sales | YoY Growth % |

| Sales | 38,742 | 100.0% | 38,068 | 100.0% | 1.8% | 42,112 | 100.0% | -8.0% |

| Other operating income | 778 | 2.0% | 628 | 1.6% | 23.9% | 793 | 1.9% | -1.9% |

| Total Revenue from operations | 39,520 | 102.0% | 38,696 | 101.6% | 2.1% | 42,905 | 101.9% | -7.9% |

| Material cost | 12,865 | 33.2% | 12,326 | 32.4% | 4.4% | 12,429 | 29.5% | 3.5% |

| Gross Profit (Excl. Other operating income) | 25,877 | 66.8% | 25,742 | 67.6% | 0.5% | 29,683 | 70.5% | -12.8% |

| Employee cost | 7,250 | 18.7% | 7,180 | 18.9% | 1.0% | 7,099 | 16.9% | 2.1% |

| Manufacturing & Other expenses | 10,874 | 28.1% | 11,507 | 30.2% | -5.5% | 13,072 | 31.0% | -16.8% |

| Operating Profit | 8,531 | 22.0% | 7,683 | 20.2% | 11.0% | 10,305 | 24.5% | -17.2% |

| Other Income | 740 | 1.9% | 320 | 0.8% | 271 | 0.6% | ||

| EBITDA | 9,271 | 23.9% | 8,003 | 21.0% | 15.8% | 10,576 | 25.1% | -12.3% |

| Depreciation & Amortization | 2,722 | 7.0% | 2,605 | 6.8% | 4.5% | 2,112 | 5.0% | 28.9% |

| EBIT | 6,549 | 16.9% | 5,398 | 14.2% | 21.3% | 8,464 | 20.1% | -22.6% |

| Finance cost | 479 | 1.2% | 439 | 1.2% | 9.1% | 287 | 0.7% | |

| PBT | 6,070 | 15.7% | 4,959 | 13.0% | 22.4% | 8,177 | 19.4% | -25.8% |

| Tax | 1,541 | 4.0% | 1,368 | 3.6% | 12.6% | 1,589 | 3.8% | -3.0% |

| Share of Profit from Joint Controlled entity | 39 | (22) | 42 | |||||

| Non-Controlling Interest | 18 | (12) | 8 | |||||

| Net Profit | 4,550 | 11.7% | 3,581 | 9.4% | 27.1% | 6,622 | 15.7% | -31.3% |

Income Statement highlights – Q2 FY2018

- Material cost increased by 80 bps to 33.2% of sales, at Rs. 12,865 m. compared to Rs. 12,326 m. in Q1 FY2018

- Personnel cost decreased by 20 bps to 18.7% of sales, at Rs. 7,250 m. compared to Rs. 7,180 m. in Q1 FY2018

- Manufacturing and other expenses decreased by 210 bps to 28.1% of sales at Rs. 10,874 m. compared to Rs. 11,507 m. in Q1 FY2018

- Investment in Research for the quarter was Rs. 4,739 m. representing 12.2% of sales

Balance Sheet highlights

- Operating working capital increased to Rs. 57,139 m. as on September 30th, 2017 compared to 54,068 m. as on June 30th, 2017. The working capital number of days stands at 128 days as on September 30th, 2017 compared to 119 days as on June 30th, 2017

- Capital Expenditure for the quarter was Rs. 2,077 m.

- Net Debt-Equity ratio for the company stands at 0.40:1

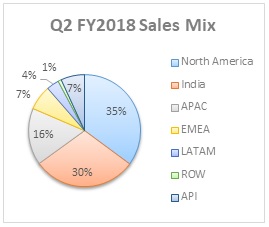

Sales Mix

| Particulars | Q2 FY2018 | Q1 FY2018 | QoQ growth % | Q2 FY2017 | YoY growth % |

| Formulations | 36,092 | 35,275 | 2.3% | 39,193 | -7.9% |

| North America | 13,611 | 16,018 | -15.0% | 19,978 | -31.9% |

| India | 11,593 | 9,324 | 24.3% | 9,958 | 16.4% |

| APAC | 6,357 | 5,989 | 6.1% | 5,520 | 15.2% |

| EMEA | 2,758 | 2,259 | 22.1% | 2,355 | 17.1% |

| LATAM | 1,395 | 1,269 | 9.9% | 986 | 41.5% |

| ROW | 378 | 416 | -9.1% | 396 | -4.5% |

| API | 2,650 | 2,793 | -5.1% | 2,919 | -9.2% |

| Total | 38,742 | 38,068 | 1.8% | 42,112 | -8.0% |

Operational Highlights

North America

Lupin’s North America sales for Q2 FY2018 were Rs. 13,611 m. compared to Rs. 16,018 m. during Q1 FY2018 and Rs. 19,978 m. during Q2 FY2017; accounting for 35% of Lupin’s global sales.

- Q2 FY2018 sales were USD 204 m. compared to USD 238 m. during Q1 FY2018 and USD 292 m. during Q2 FY2017

- The Company launched 5 products in the US market during the quarter. The Company now has 147 products in the US generics market

- Lupin is now the market leader in 43 products in the US generics market and amongst the Top 3 in 91 of its products (market share by prescriptions, IMS Health, June 2017)

India

Lupin’s India formulation sales grew by 24.3% to Rs. 11,593 m. during Q2 FY2018 compared to Rs. 9,324 m. during Q1 FY2018 and increased by 16.4% compared to Rs. 9,958 m. during Q2 FY2017; accounting for 30% of Lupin’s global sales.

Asia-Pacific (APAC)

Lupin’s APAC sales grew by 6.1% to Rs. 6,357 m. during Q2 FY2018 compared to Rs. 5,989 m. during Q1 FY2018 and increased by 15.2% compared to Rs. 5,520 m. during Q2 FY2017; accounting for 16% of Lupin’s global sales.

Lupin’s Japan sales increased by 1.2% to JPY 8,685 m. during Q2 FY2018 compared to JPY 8,585 m. during Q1 FY2018 and increased by 29.6% compared to JPY 6,700 m. in Q2 FY2017.

Lupin’s Philippines sales increased by 44.0% to PHP 504 m. during Q2 FY2018 compared to PHP 350 m. during Q1 FY2018 and increased by 12.6% compared to PHP 448 m. during Q2 FY2017.

Europe, Middle-East and Africa (EMEA)

Lupin’s EMEA sales grew by 22.1% at Rs. 2,758 m during Q2 FY2018 compared to sales of Rs. 2,259 m. during Q1 FY2018 and increased by 17.1% compared to Rs. 2,355 m. during Q2 FY2017; accounting for 7% of Lupin’s global sales.

Lupin’s South Africa sales increased by 29.0% at ZAR 270 m. during Q2 FY2018 compared to ZAR 209 m. during Q1 FY2018 and increased by 6.9% compared to ZAR 252 m. during Q2 FY2017. Lupin remains the 4th largest generic player in the South African market.

Lupin’s Germany sales increased by 13.4% at Euro 7.6 m. during Q2 FY2018 compared to Euro 6.7 m. during Q1 FY2018 and increased by 19.5% compared to Euro 6.4 m. during Q2 FY2017.

Latin America (LATAM)

Lupin’s LATAM sales grew by 9.9% at Rs. 1,395 m. during Q2 FY2018 compared to Rs. 1,269 m. during Q1 FY2018 and grew by 41.5% as compared to Rs. 986 m. during Q2 FY2017; accounting for 4% of Lupin’s global sales.

Lupin’s Brazil sales increased by 12.1% to BRL 40 m. during Q2 FY2018 compared to BRL 36 m. during Q1 FY2018 and increased by 30.1% compared to BRL 31 m. during Q2 FY2017.

Lupin’s Mexico sales increased by 3.3% to MXN 154 m. during Q2 FY2018 compared to MXN 149 m. during Q1 FY2018 and increased by 66.2% compared to MXN 93 m. during Q2 FY2017.

Global API

Global API sales were Rs. 2,650 m. during Q2 FY2018 compared to Rs. 2,793 m. during Q1 FY2018 and Rs. 2,919 m. during Q2 FY2017; accounting for 7% of Lupin’s global sales.

Research and Development

Revenue Expenditure on R&D during Q2 FY2018 amounted to Rs. 4,739 m., 12.2% of sales as against Rs. 4,999 m., 13.1% of sales during Q1 FY2018 and Rs. 5,716 m., 13.6% of sales during Q2 FY2017.

Lupin filed 10 ANDA and received 9 approvals from the US FDA during the quarter. The Company also received one NDA approval during the quarter. Cumulative ANDA filings with the US FDA stood at 377 as of September 30th, 2017, with the company having received 225 approvals to date. The Company now has 49 First-to-Files (FTF) filings including 25 exclusive FTF opportunities. Cumulative DMF filings stands at 188 as of September 30th, 2017.

The Company received approval for 1 MAA from the European authority during the quarter. Cumulative filings with European authorities now stands at 61 with the company having received 58 approvals to date.

About Lupin Limited

Lupin is an innovation led transnational pharmaceutical company developing and delivering a wide range of branded & generic formulations, biotechnology products and APIs globally. The Company is a significant player in the Cardiovascular, Diabetology, Asthma, Pediatric, CNS, GI, Anti-Infective and NSAID space and holds global leadership position in the Anti-TB segment.

Lupin is the 8th and 6th largest generics pharmaceutical company by market capitalization (September 30th, 2017, Bloomberg) and revenues (March 31st, 2017, Bloomberg) respectively. The Company is the 4th largest pharmaceutical player in the US by prescriptions (Quintiles IMS MAT March 2017); 2nd largest Indian pharmaceutical company by global revenues (March 31st, 2017, Bloomberg); 6th largest generic pharmaceutical player in Japan and 6th largest company in Indian Pharmaceutical Market (Quintiles IMS MAT September 2017).

For the financial year ended 31st March, 2017, Lupin’s Consolidated sales and Net profit stood at Rs. 171,198 million (USD 2.55 billion) and Rs. 25,575 million (USD 381 million) respectively. Please visit http://www.lupin.com for more information.

You could also follow us on Twitter – www.twitter.com/lupinlimited

CIN: L24100MH1983PLC029442 Registered Office: Lupin Ltd, 3rd Floor, Kalpataru Inspire, Off Western Express Highway, Santacruz (East), Mumbai 400 055.

For further information or queries please contact –

Pooja Thakran

VP – Corporate communications

Ph: +91-22 6640 2531 / 9811665000

Email: poojathakran@lupin.com

or

Arvind Bothra

Sr. GM – Investor Relations and M&A

Ph: +91-22 6640 2137

Email: arvindbothra@lupin.com