Mumbai, August 03, 2023: Pharma major Lupin Limited [BSE: 500257 | NSE: LUPIN] reported its financial performance for the quarter ending June 30, 2023. These unaudited results were taken on record by the Board of Directors at a meeting held today.

Financial Highlights – Consolidated IND-AS

Amt in INR mn

| Particulars | Quarter | ||||

| Q1 FY2024 | Q4 FY2023 | QoQ Growth % | Q1 FY2023 | YoY Growth % | |

| Sales | 47,421 | 43,303 | ↑9.5% | 36,040 | ↑31.6% |

| EBITDA | 8,791 | 6,150 | ↑ 42.9% | 2,379 | ↑ 269.6% |

| EBITDA Margin (%) | 18.5% | 14.2% | ↑ 430 bps | 6.6% | ↑ 1190 bps |

| PBT | 5,588 | 2,585 | ↑116.2% | 23 | ↑24516.3% |

Income Statement highlights – Q1 FY2024

- Gross Profit was INR 31,013 mn compared to INR 25,803 mn in Q4 FY2023, with gross margin of 65.4%

- Personnel cost was 17.8% of sales at INR 8,444 mn compared to INR 7,730 mn in Q4 FY2023

- Manufacturing and other expenses were 31.0% of sales at INR 14,724 mn compared to INR 13,030 mn in Q4 FY2023

- Investment in R&D for the quarter was INR 3,679 mn (7.8% of sales)

Balance Sheet highlights

- Operating working capital was INR 51,946 mn as on June 30, 2023

- Capital Expenditure for the quarter was INR 1,171 mn

- Net Debt as on June 30, 2023 stands at INR 13,099 mn

- Net Debt-Equity as on June 30, 2023 stands at 0.10

Commenting on the results, Mr. Nilesh Gupta, Managing Director, Lupin Limited said, “Building on the momentum of the last few quarters, we had a strong quarter with good growth across all key markets as we continue to improve our operating margins driven by higher sales, better mix and cost optimization initiatives. Our India branded business has bounced back to double-digit growth despite NLEM price reductions. With the clearance of Pithampur Unit-2 we expect to add to the product approvals for the US region. Getting approvals for important complex generics like Tiotropium DPI, and getting back into the launch tempo with first to market products like Darunavir and additional new product launches will help sustain the growth momentum both in topline and bottom line as we move ahead”

Consolidated Financial Results Q1 FY2024

Amt in INR mn

| Particulars | Q1 FY2024 | % of sales | Q4 FY2023 | % of sales | QoQ Gr% | Q1 FY2023 | % of sales | YoY Gr% |

| Sales | 47,421 | 100.0% | 43,303 | 100.0% | 9.5% | 36,040 | 100.0% | 31.6% |

| Other operating income | 720 | 1.5% | 998 | 2.3% | -27.9% | 1,398 | 3.9% | -48.5% |

| Total Revenue from operations | 48,141 | 101.5% | 44,301 | 102.3% | 8.7% | 37,438 | 103.9% | 28.6% |

| Material cost | 16,408 | 34.6% | 17,501 | 40.4% | -6.2% | 16,098 | 44.7% | 1.9% |

| Gross Profit (Excl. Other op. income) | 31,013 | 65.4% | 25,802 | 59.6% | 20.2% | 19,942 | 55.3% | 55.5% |

| Employee cost | 8,444 | 17.8% | 7,730 | 17.9% | 9.2% | 7,785 | 21.6% | 8.5% |

| Manufacturing & Other expenses | 14,724 | 31.0% | 13,030 | 30.1% | 13.0% | 11,916 | 33.1% | 23.6% |

| Other Income | 228 | 0.5% | 373 | 0.9% | -38.9% | 56 | 0.2% | 307.1% |

| Forex Loss / (Gain) | 2 | 0.0% | 263 | 0.6% | -99.3% | (684) | -1.9% | -100.3% |

| EBITDA | 8,791 | 18.5% | 6,150 | 14.2% | 42.9% | 2,379 | 6.6% | 269.5% |

| Depreciation, Amortization & Impairment Expense | 2,346 | 4.9% | 2,640 | 6.1% | -11.1% | 1,928 | 5.3% | 21.7% |

| EBIT | 6,445 | 13.6% | 3,510 | 8.1% | 83.6% | 451 | 1.3% | 1329.0% |

| Finance cost | 857 | 1.8% | 925 | 2.1% | -7.4% | 428 | 1.2% | 100.2% |

| Profit Before Tax (PBT) | 5,588 | 11.8% | 2,585 | 6.0% | 116.2% | 23 | 0.1% | 24516.3% |

| Tax | 1,055 | 2.2% | 161 | 0.4% | 891 | 2.5% | ||

| Profit After Tax (PAT) | 4,533 | 9.6% | 2,424 | 5.6% | (868) | -2.4% | ||

| (+) Share of Profit from JV | – | – | – | – | – | – | ||

| (-) Non-Controlling Interest | 10 | 0.0% | 64 | 0.1% | 23 | 0.1% | ||

| Profit/(Loss) for the period | 4,523 | 9.5% | 2,360 | 5.4% | (891) | -2.5% | ||

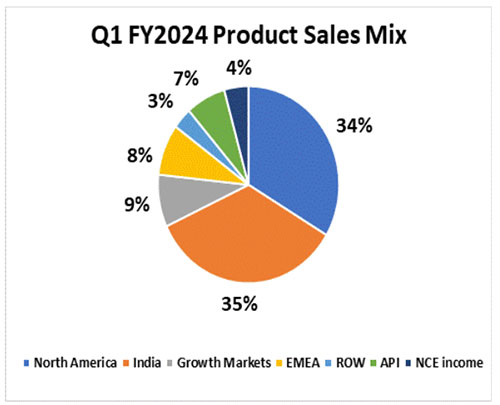

Sales Mix

Amt in INR mn

| Particulars | Q1 FY2024 | Q4 FY2023 | Growth QoQ | Q1 FY2023 | Growth YoY |

| North America | 15,905 | 15,503 | 2.6% | 10,104 | 57.4% |

| India | 16,384 | 14,786 | 10.8% | 14,920 | 9.8% |

| Growth Markets | 4,066 | 4,385 | -7.3% | 4,237 | -4.0% |

| EMEA | 3,987 | 4,535 | -12.1% | 3,335 | 19.6% |

| ROW | 1,655 | 868 | 90.6% | 893 | 85.3% |

| Total Formulations | 41,997 | 40,077 | 4.8% | 33,489 | 25.4% |

| API | 3,371 | 3,226 | 4.5% | 2,551 | 32.1% |

| Total Product Sales | 45,368 | 43,303 | 4.8% | 36,040 | 25.9% |

| NCE Income | 2,053 | – | NA | – | NA |

| Consolidated Sales | 47,421 | 43,303 | 9.5% | 36,040 | 31.6% |

Operational Highlights

North America

North America sales for Q1 FY2024 were INR 15,905 mn, up 2.6% compared to INR 15,503 mn in Q4 FY2023; up 57.4% as compared to INR 10,104 mn in Q1 FY2023; and accounted for 34% of Lupin’s global sales.

Q1 FY2024 sales were USD 181 mn compared to USD 175 mn in Q4 FY2023 and USD 121 mn in Q1 FY2023.

The Company received 4 ANDA approvals from the U.S. FDA, and launched 3 products in the quarter in the U.S. The Company now has 158 generic products in the U.S.

Lupin continues to be the 3rd largest pharmaceutical player in both U.S. generic market and U.S. total market by prescriptions (IQVIA MAT June 2023). Lupin is the leader in 41 of its marketed generics in the U.S. and amongst the Top 3 in 109 of its marketed products (IQVIA March 2023).

India

India formulation sales for Q1 FY2024 were INR 16,384 mn, up 10.8% as compared to INR 14,786 mn in Q4 FY2023; up 9.8% as compared to INR 14,920 mn in Q1 FY2023; and accounted for 35% of Lupin’s global sales.

India Region Formulations sales grew by 11.6% in the quarter as compared to Q4 FY2023, up 10.6% as compared to Q1 FY2023. The company launched 4 brands across therapies during the quarter.

Lupin is the 6th largest company in the Indian Pharmaceutical Market (IQVIA MAT June 2023).

Growth Markets (LATAM and APAC)

Growth Markets registered sales of INR 4,066 mn for Q1 FY2024, down 7.3% compared to INR 4,385 mn in Q4 FY2023; down 4.0% as compared to INR 4,237 mn in Q1 FY2023; and accounted for 9% of Lupin’s global sales.

Brazil sales were BRL 75 mn for Q1 FY2024, compared to BRL 75 mn for Q4 FY2023 and BRL 57 mn for Q1 FY2023.

Mexico sales were MXN 86 mn for Q1 FY2024, compared to MXN 152 mn for Q4 FY2023 and MXN 213 mn for Q1 FY2023.

Philippines sales were PHP 463 mn for Q1 FY2024, compared to PHP 542 mn for Q4 FY2023 and PHP 434 mn for Q1 FY2023.

Australia sales were AUD 26 mn for Q1 FY2024, compared to AUD 24 mn for Q4 FY2023 and AUD 25 mn for Q1 FY2023.

Europe, Middle-East and Africa (EMEA)

EMEA sales for Q1 FY2024 were INR 3,987 mn, down 12.1% compared to INR 4,535 mn in Q4 FY2023; up 19.6% compared to INR 3,335 mn in Q1 FY2023; and accounted for 8% of Lupin’s global sales.

South Africa sales were ZAR 295 mn for Q1 FY2024, compared to ZAR 417 mn for Q4 FY2023 and ZAR 282 mn for Q1 FY2023. Lupin is the 8th largest player in South Africa in the total generics market (IQVIA May 2023).

Germany sales were EUR 10 mn for Q1 FY2024, compared to EUR 10 mn for Q4 FY2023 and EUR 9 mn for Q1 FY2023.

Global API

Global API Sales for Q1 FY2024 were INR 3,371 mn, up 4.5% as compared to INR 3,226 mn in Q4 FY2023; up 32.1% as compared to INR 2,551 mn in Q1 FY2023; and accounted for 7% of Lupin’s global sales.

Research and Development

Investment in R&D was INR 3,679 mn (7.8% of sales) for Q1 FY2024 as compared to INR 3,050 mn (7.0% of sales) for Q4 FY2023.

Lupin received approval for 4 ANDAs from the U.S. FDA in the quarter. Cumulative ANDA filings with the U.S. FDA stand at 443 as of June 30, 2023, with the company having received 294 approvals to date.

The Company now has 54 First-to-File (FTF) filings including 21 exclusive FTF opportunities. Cumulative U.S. DMF filings stand at 169 as of June 30, 2023.

About Lupin

Lupin is an innovation-led transnational pharmaceutical company headquartered in Mumbai, India. The Company develops and commercializes a wide range of branded and generic formulations, biotechnology products, and APIs in over 100 markets in the U.S., India, South Africa, and across the Asia Pacific (APAC), Latin America (LATAM), Europe, and Middle East regions.

The Company enjoys a leadership position in the cardiovascular, anti-diabetic, and respiratory segments and has a significant presence in the anti-infective, gastro-intestinal (GI), central nervous system (CNS), and women’s health areas. Lupin is the third-largest pharmaceutical company in the U.S. by prescriptions. The company invested 7.9% of its revenue in research and development in FY23.

Lupin has 15 manufacturing sites, 7 research centers, more than 20,000 professionals working globally, and has been consistently recognized as a ‘Great Place to Work’ in the Biotechnology & Pharmaceuticals sector.

Please visit www.lupin.com for more information.

Follow us on:

Twitter: https://twitter.com/LupinGlobal

LinkedIn: https://www.linkedin.com/company/lupin

Facebook: http://www.facebook.com/LupinWorld/

For further information or queries please contact –

Shweta Munjal

Vice President & Global Head – Corporate Communications & Sustainability

Email: shwetamunjal@lupin.com